Here are this week’s reading links and fiscal facts:

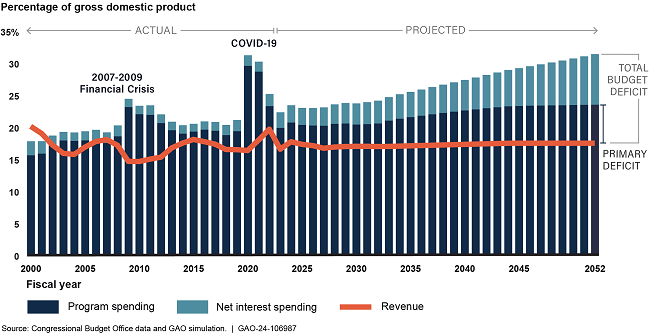

Debt forecasts are highly sensitive to interest rate assumptions. Brian Knight asked Mercatus’ Eric Leeper to do back-of-the-envelope calculations on how different interest rate assumptions change federal debt projections. “All else being equal, a 2.0 percent increase in average interest rates means that the debt reaches 150 percent of GDP by ~2035 and 200 percent by 2043.” As the Manhattan Institute’s Brian Riedl warned in 2021, “several realistic economic scenarios could easily push interest rates back up to 4%–5% within a few decades—which would coincide with a projected debt surge to greatly increase federal budget interest costs. Debt doves have no backup plan for this possibility.” The Government Accountability Office illustrates the growth in the deficit and net interest costs in the graphic below.

Entitlements drive increased federal spending. The Committee for a Responsible Federal Budget writes, “84 percent of [spending] growth can be explained by increased spending on health, Social Security, and net interest.” Congress cannot solve the country’s deteriorating fiscal state without addressing major entitlements, including Social Security and Medicare. See the video below on why a well-designed fiscal commission is necessary to tackle debt and deficits.

Immigration boosts projected revenues. The Congressional Budget Office Director Phill Swagel explains, “In our projections, the deficit is also smaller than it was last year because economic output is greater, partly as a result of more people working. The labor force in 2033 is larger by 5.2 million people, mostly because of higher net immigration. As a result of those changes in the labor force, we estimate that, from 2023 to 2034, GDP will be greater by about $7 trillion and revenues will be greater by about $1 trillion than they would have been otherwise.” Cato’s David Bier argues that reforming the legal immigration system, including increasing green card caps, would “put America back on a fiscally and economically sustainable demographic path.” For more on the net fiscal impact of immigrants, see here.

Social Security’s increasing generosity. As the American Enterprise Institute’s Ramesh Ponnuru wrote in 2018, the argument that deficits are rising because of an aging population and increased health care costs glides over a key point: the initial Social Security check size is tied to wage levels, not pricing. “Because wages have usually grown faster than prices, today’s retirees get bigger checks than yesterday’s, even when you adjust for inflation.” Adopting price indexing for initial benefits (tying them to inflation instead of wage growth) would preserve current benefits and protect beneficiaries from inflation while reducing excess benefit cost growth and closing Social Security’s funding gap.

Rolling back the retirement tax break faces pushback. Andrew Biggs and Alicia Munnell recently suggested eliminating retirement tax breaks to fund Social Security. Cato’s Adam Michel argues, “Increasing taxes that directly reduce personal savings and undermine the private alternative to the broken government‐run system would be particularly destructive to America’s future retirees.” Eugene Steuerle points out that funneling general revenue increases into Social Security’s trust funds requires Treasury to make hypothetical estimates of future revenues and deposit into the trust fund through an algorithmic formula. Biggs responds to critics here. As he rightly points out, the US provides maximum benefits far in excess of other comparable nations (see the AEI graphic below). A more elegant reform would move to a flat benefit system, preserving benefits for those who most need them.

Alright, dumb question. I understand why higher interest rates, all else being equal, increase our total debt burden. But higher interest rates are ordinarily a function of high nominal gdp growth, and lower interest rates the opposite. So why is it that a high nominal gdp growth, high interest rate equilibrium would lead to a lower debt:gdp ratio than a low interest rate low growth equilibrium?