Social Security Benefits Are Growing Too Fast

Adopting price indexing for initial benefits preserves current benefits, protects beneficiaries from inflation, and reduces excess benefit cost growth

Here’s an unpopular opinion: Social Security benefits are growing too fast. And this excessive benefit growth is one of the key reasons the program is unsustainable.

We’ve all heard that entitlement programs are suffering under the weight of a demographic shift. The American population is aging and living longer, as fertility has declined. Fewer new workers as the share of the senior population increases means fewer taxpayers available to cover the cost of old-age benefits.

This is true. And it’s also true that we could solve a lot of the entitlement spending problem, without cutting a single penny from current benefits, by slowing the growth in benefits.

In the case of Social Security, benefits are growing much faster than inflation. This is by design. And the difference is sizeable.

Prior to 1972, it took an Act of Congress to adjust Social Security benefits as they weren’t indexed to any economic measure. This meant that during periods of inflation, the purchasing power of benefits would decline until Congress passed a benefit increase. Amendments in 1972 adopted the consumer price index for automatically adjusting current benefits for inflation. By 1977, Congress adopted further amendments, this time determining that initial benefits would be indexed to wage growth. To this day, workers’ initial benefit levels are indexed to wage growth and ongoing benefits adjust with price growth.

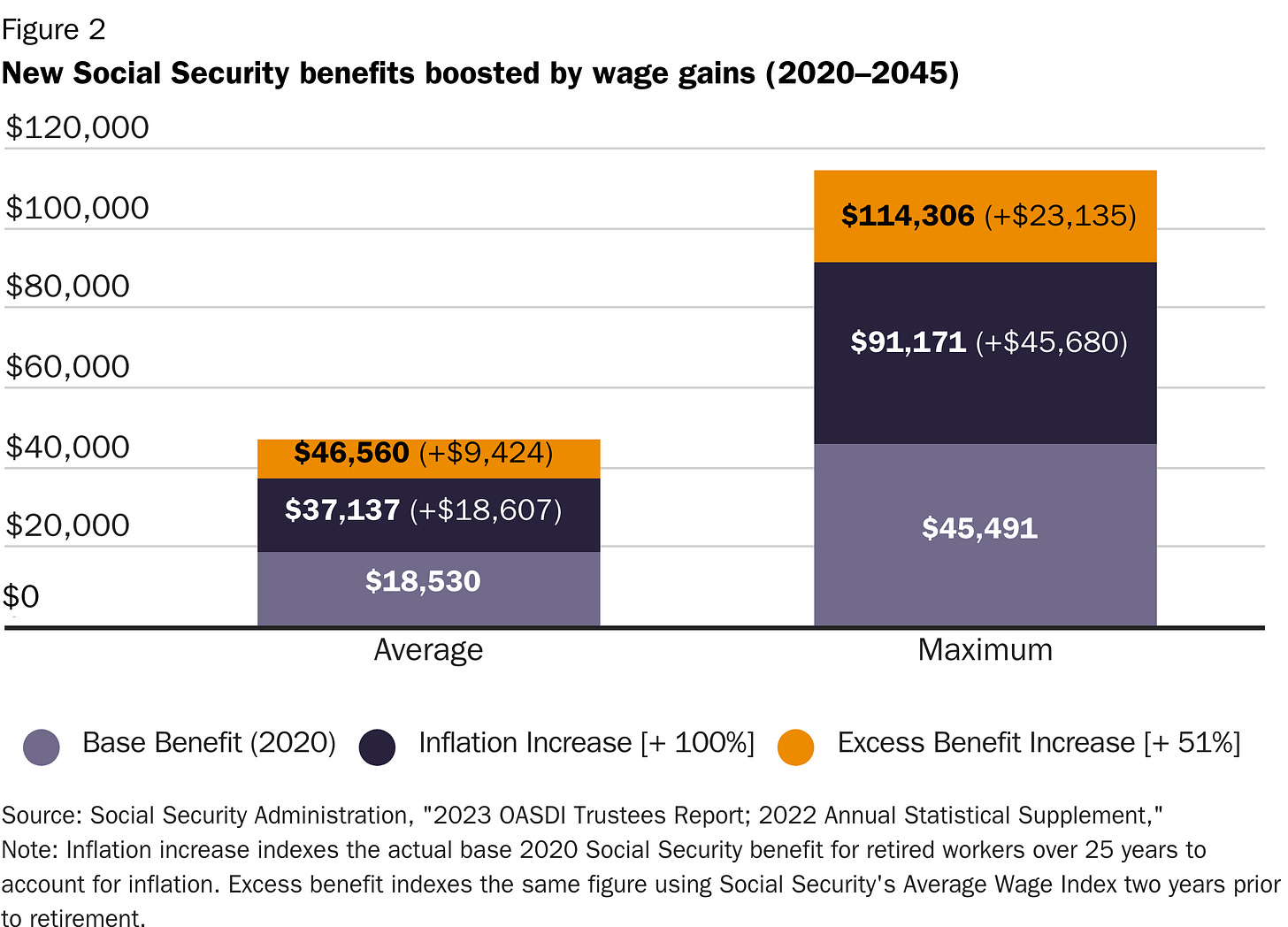

The chart below shows the growth in workers’ initial benefit amounts over a period of 25 years, adjusted for inflation (for comparison) and wage growth (which tends to grow faster than inflation).

Here’s an example to illustrate the point: When Chris (an average American wage earner) decided to claim Social Security in 2020, she began receiving $18,231 per year. Pat on the other hand, with a very similar earnings history as Chris, claimed benefits 25 years earlier, in 1995, and she receives $14,545 in 2020—Pat’s initial benefit of $8,638, adjusted for 25 years of inflation.

Why are Pat and Chris, who earned the same and contributed the same payroll taxes to Social Security over their lifetimes, receiving wildly different benefits in 2020?

That’s the power of wage indexing. When Chris applied for benefits in 2020, she didn’t receive the same benefit as Pat, adjusted for inflation. Instead, Chris benefited from a $3,686 bump-up to reflect the increase in the standard of living, after inflation, that occurred between 1993 and 2018. Basically, Social Security counts Chris’s 1995 wages as if they’d been earned in 2018, instead of the actual wages she earned in 1995. (2018 instead of 2020 because Social Security uses the average wage index for two years prior to retirement. Thus, a person retiring in 2020 would see their wages through 2018 indexed to the 2018 average wage index; the two years immediately before retirement. This indexing increases past earnings to account for average wage growth.)

Some might argue that this is a good thing. Perhaps one of the goals of Social Security should be to raise the standard of living in retirement for average-wage workers by giving them a boost based on wage gains that occurred since they started working. After all, an important principle embedded in Social Security’s design is to redistribute some income from higher-earning workers to those lower on the income scale.

However, higher-earning workers also benefit from this excess benefit adjustment. Here’s another example featuring Jordan and Riley, high-income workers retiring 25 years apart. Jordan applied for benefits in 2020 and now collects $37,000 in annual income from the program. Riley, with the same earnings history and tax contributions collects $8,000 less, because she applied in 1995 and her benefits stayed the same, except for increasing with inflation. That doesn’t seem particularly fair but this is how the program works.

How benefit indexing works: When a Social Security-eligible worker’s benefits are first calculated, this worker’s past wages are indexed to bring them to the same level as today’s earnings. This is called wage indexing and is based on the growth in average wages in the economy. When the Social Security Administration (SSA) first indexes a worker’s lifetime covered earnings, it uses the SSA’s Average Wage Index (AWI). The AWI includes all wages that are subject to federal income tax, including wages in excess of the taxable Social Security maximum payroll tax threshold. Wage indexing gives retirees a benefit amount that reflects the increase in the standard of living over their working careers—even if they didn’t earn commensurate wages. It’s like giving workers retroactive credit for improvements in the economy, including for wage improvements among the highest income earners. After initial monthly benefits are determined, they will be price indexed to preserve the benefits’ purchasing power against inflation – that’s the annual COLA (cost-of-living adjustment) that Social Security beneficiaries get when overall prices in the economy are going up.

The below chart shows how continuing initial benefit calculations using wage indexing will increase Social Security benefits in excess of inflation in the future. A maximum-benefit-eligible beneficiary retiring at age 70 in 2045 would receive an annual benefit of $114,306—more than $23,000 higher, after adjusting for inflation, than a similarly situated worker retiring in 2020.

How much would this policy change save? According to the Social Security Trustees, switching to a benefit formula that adjusts workers’ initial benefits for inflation, rather than the growth in average wages, would close 80 percent of the program’s 75-year funding gap and lead to a surplus in the 75th year, if such a policy began in 2029. Limiting the formula change to the highest 70 percent of earners (this is often called progressive price indexing) would close Social Security’s 75-year funding gap by 45 percent and achieve near-solvency in the 75th year, balancing out revenues and spending at 95 percent, assuming this change took place beginning in 2029. Figure 3 compares Social Security’s projected funding gap under current policy, progressive price indexing, and regular price indexing.

Adopting price indexing for initial benefits would preserve current benefits and protect beneficiaries from inflation while reducing excess benefit cost growth.

Changing the initial benefit formula to account for inflation instead of wage gains is one of the most significant changes that Congress could undertake. Adopting price indexing for initial benefits would preserve current benefits and protect beneficiaries from inflation while reducing excess benefit cost growth.

How would this change affect the purchasing power of seniors? When President Roosevelt signed Social Security into law, he referred to it as “a law which will give some measure of protection to the average citizen and to his family…against poverty‐ridden old age.” From a modest income support program, targeted toward individuals who lived beyond the age of life expectancy, Social Security now redistributes more than $1 trillion annually from working Americans toward those in retirement, despite the much greater wealth owned by retirees.

The median net worth of working Americans aged 35–44 was $91,300 in 2019, based on the Fed’s Survey of Consumer Finances. Meanwhile median net worth among those 65 and older was nearly three times that, at $266,400 for those in the 65 to 74 age bracket, and $254,800 for those 74 years and older.

As John Cogan, author of The High Cost of Good Intentions (2017), has argued in this Mont Pelerin Society report from 2020:

“modest Social Security changes to limit the growth in the inflation-adjusted value of initial monthly benefits and to raise the retirement age will maintain benefit levels that are fully consistent with the original objectives of the Social Security wage-indexing policy of helping senior citizens avoid a precipitous drop in their standard of living upon retiring and of helping senior citizen standards of living to keep pace with those of the working age population.”

When comparing the growth in the inflation-adjusted median income of households headed by persons age 65 or older (senior; considering all income, including from Social Security and other sources such as pensions and retirement account withdrawals) and the growth in the median income of households headed by persons under age 65 (non-senior) since 1980, shortly after Social Security adopted wage indexing, Cogan finds that:

“in the years since wage-indexing was established, incomes of senior households who are largely the group collecting Social Security, has not just kept pace with that of non-senior households, who are largely the group paying taxes to finance these benefits, it has a grown about four times faster. The more rapid income growth among senior households compared to the income of the typical working household has been an across the-board phenomenon [emphasis added].”

Cogan argues that if seniors’ initial Social Security benefits had been indexed to inflation, instead of wages, senior household income would have still grown twice as fast as non-senior household income, over the 40-year period since 1980. This is because most of the increase in senior household income is due to higher earnings from work and increases in retirement income, rather than increases in Social Security benefits.

It’s unnecessary and unfair to burden a declining share of workers with higher taxes to pay out benefits to a growing share of retirees. Such a policy is particularly offensive when those on the receiving end of an income transfer are better off than those providing the transfer.

It’s not only unnecessary and unfair to burden a declining share of workers with higher taxes to pay out benefits to a growing share of retirees, but such a policy is particularly offensive when those on the receiving end of an income transfer are better off than those providing the transfer. Shifting to price indexing for calculating initial benefits, at the very least when calculating benefits for higher income earners, is a sensible policy change. It would help avoid indiscriminate benefit cuts when Social Security’s trust fund borrowing authority runs dry (benefits would be automatically cut by 23 percent in 2033) and avert economically harmful tax increases to finance unsustainable benefit growth.

There’s a way to reduce Social Security’s financial and economic burden and eliminate its unfunded obligations over the long-term, and it requires no benefit cuts, but merely reductions in the growth of benefits. Now we just need to find the political will.