I’m hiring! Do you know a liberty-minded rising star in econ or public policy who wants to make an outsized impact on federal budget policy? I am looking for a research associate (RA) to work on federal budget and entitlements policy with me. The RA will have the opportunity to:

📚 learn from some of the best experts in the field;

💡 establish themselves as a thought leader on a federal budget issue;

📈 grow by 10X professionally and personally from direct feedback and actionable guidance.

Remote, hybrid, or in-office, per candidate preference. Excellent benefits package included. Apply here!

This is the last debt digest for 2023 as we take a break for the holidays. We look forward to bringing you more fiscal facts and insights in the new year. Thank you for reading and sharing our work!

Here are this week’s reading links and fiscal facts:

‘Liquid Gold’ won’t save Social Security. Donald Trump suggested tapping into America’s oil and gas reserves to solve Social Security’s budgetary shortfalls. As the Committee for a Responsible Federal Budget explains, “dedicating current oil and gas leasing revenues to Social Security would cover less than 4 percent of its shortfall, and it would be impossible to fix Social Security even if all federal land were opened to drilling operations.” Addressing Social Security insolvency will require addressing the fact that benefits are growing faster than inflation. Adopting price indexing for initial benefits is one option that preserves current benefits and reduces excess benefit cost growth.

Entitlement benefits exceed payroll taxes. Joe Biden and Donald Trump have stated that Social Security benefits are ‘earned’ notes Andrew G. Biggs of the American Enterprise Institute. “Yet the numbers tell a different story. The Congressional Budget Office and Social Security Administration both find that most Americans are promised Social Security and Medicare benefits substantially exceeding the taxes they’ll pay over their lifetimes.” Biggs suggests reducing Social Security and Medicare benefits for the wealthiest beneficiaries.

Prioritize spending cuts to address the looming fiscal crisis. Paul Winfree of the Economic Policy Innovation Center writes, “Congress must thread this needle: bring down the supply of debt without compromising economic growth. In practical terms, this means Congress needs to signal to the credit markets that it needs to authorize less debt over time while also taking tax increases off the table. […] [R]aising taxes is not a prerequisite to confronting the debt crisis. Spending cuts and higher revenue are not equal choices, just as bloated government and economic growth are not equal outcomes.” Cato’s Adam Michel concurs, writing, “Fiscal adjustments that focus on reducing expenditures are historically most successful at returning countries to economic growth while also lowering debt-to-GDP ratios by restoring public confidence in government fiscal capacity.”

No budget, no pay? No-brainer. Nicholas Johns for the National Taxpayer Union highlighted ten commonsense bills that are pro-taxpayer and bipartisan. One reform idea that’s been brought back into the spotlight thanks to presidential hopeful Nikki Haley: No Budget, No Pay. Congress has habitually missed deadlines and failed to complete its budgetary homework. Withholding congressional pay could encourage legislators to start budgeting responsibly.

Cutting taxes is a bipartisan instinct. “It is common knowledge that most Republicans support tax cuts. It is often left out of the conversation that Democratic politicians also support trillions of dollars in tax cuts without proposing realistic offsets,” writes Adam Michel. “President Biden’s budget supports extending about $2 trillion of the Trump‐era tax cuts, in addition to expanding tax‐credit subsidies included in his multi‐trillion‐dollar Build Back Better spending plan. […] Politicians’ desire to keep taxes low is admirable, but keeping taxes low for the long haul will also require keeping spending in check.”

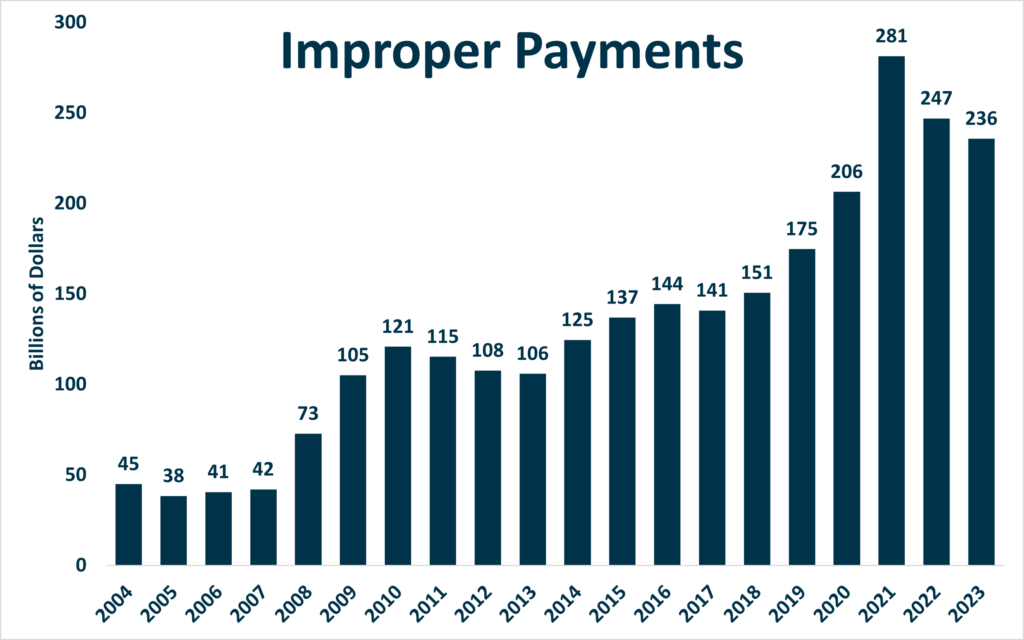

Improper payments exceed funding for the US Army. Improper payments are “payments that should not have been made or that were made in an incorrect amount,” according to the Congressional Research Service. The cost of improper payments is more significant than you might think, explains Matthew Dickerson of the Economic Policy Innovation Center (EPIC). “The federal government reported at least $2.6 trillion in improper payments over the last 20 years. In fiscal year 2023, improper payments totaled $236 billion.” See EPIC’s chart below. “The best way to prevent improper payments would be to restrain government spending. Preventing improper payments before they occur is vital to protect taxpayers, because it can be difficult and costly to attempt to recoup funds once they have already left the Treasury.”