Here are this week’s reading links and fiscal facts:

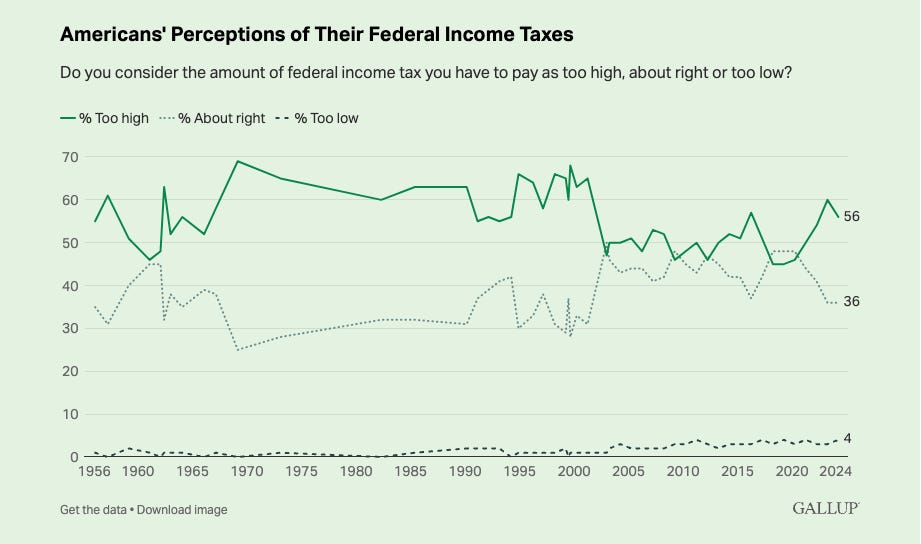

Americans could be in for a rude debt awakening. A recent Gallup survey shows that 56 percent of Americans think their federal income taxes are “too high” [see the figure below]. However, with unsustainable government spending driving record levels of debt and persistent deficits, Americans may soon see their taxes rise much further. As my colleague at the Cato Institute, Adam Michel, highlighted in his recent policy analysis, “Absent significant spending reforms, Americans may face a future resembling the European tax system, requiring an almost 50 percent tax increase on many middle-class Americans. America can avoid the European fiscal model by decisively cutting major spending programs to reduce the current $2 trillion annual federal budget deficit.” As I’ve written before, “We need rules that bind lawmakers to limit the propensity of government to expand and to protect future generations [...] As Buchanan and George Mason University economist Richard Wagner wrote in Democracy in Deficit, ‘Budgets cannot be left adrift in the sea of democratic politics.’”

TCJA extensions should be paired with spending cuts. Fiscal leaders with Arnold Ventures, the Bipartisan Policy Center, the Committee for a Responsible Federal Budget, and the Peter G. Peterson Foundation sent a letter to the House Committee on Ways and Means, emphasizing fiscal responsibility in dealing with the expirations of the Tax Cuts and Jobs Act (TCJA) next year: “We encourage you to pair TCJA extensions you choose to make with accompanying offsets in an effort to advance the principles of tax reform without increasing the deficit, and we want to work with you to help achieve that goal.” It also cites the new Cato tax plan, authored by Adam Michel, which calls for tax cuts without adding to deficits. Michel argues: “Tax cuts without offsetting spending cuts shift the cost of the unfunded spending onto future taxpayers and disguise the actual cost of current government services through so-called fiscal illusion.”

The Epoch Times’s Mark Tapscott quotes me on Social Security’s benefit formula. A recent Epoch Times article by Mark Tapscott discusses Social Security reform, highlighting Rep. John Larson’s (D-CT) Social Security 2100 Act, which would raise taxes on working Americans, and Sen. Bill Cassidy’s (R-LA) idea to create a Social Security fund that would be funded by borrowing and invest in the stock market. As an alternative to these proposals, the article mentions my recommendation to index initial benefits to prices rather than wages: “Romina Boccia, director of budget and entitlement policy for the Cato Institute, points to the current system’s formula for calculating how much a beneficiary should receive. Boccia calculates that switching the benefit formula to inflation indexing rather than wage indexing at the outset of a beneficiary’s checks would dramatically slow the rate of growth without cutting total benefits. ‘Wage indexing leads to higher benefits for future retirees compared to current ones, driving up long-term costs, especially since wage growth tends to outpace inflation,’ Boccia told the Epoch Times. ‘By tying initial benefits to inflation, price indexing slows the growth in future benefits, helping to extend Social Security’s solvency without cutting benefits for today’s retirees,’ she said. The Cato scholar pointed to a 2023 Social Security Trustees report that she said calculated such a switch ‘would close 80 percent of the program’s 75-year funding gap and lead to a surplus in the 75th year, if such a policy began in 2029.’” See more about switching initial benefits to price indexing here.

A government efficiency commission could put a spotlight on the risks of America’s debt crisis. House Budget Committee Chairman Jodey Arrington (R-TX) calls former President Trump’s proposed Government Efficiency Commission, to be led by Elon Musk, a disruptive reform that can set a path toward restoring the nation’s fiscal health. Rep. Arrington explains: “Trump and Musk can use the Commission to spotlight the potential irreparable fallout from a debt-induced crisis and the urgent need to get ahead of it. Without these changes, America’s standing in the world declines, our competitiveness with China weakens, interest rates could spike, economic growth stalls and the dollar’s status as the world’s reserve currency is jeopardized. The reality is, far too many Americans don’t have a grip on the magnitude of the debt-induced perils we face.” As I’ve previously covered, “U.S. government spending is on a collision course with economic disaster. Legislators need not lift another finger to increase spending any further. The U.S. federal budget is on a Titanic‐esque voyage that could result in a fatal crash with a massive iceberg of unfunded entitlement obligations. This ship also has no captain. It is racing full steam ahead on autopilot. Failure to grab the helm and change course undermines living standards, technological progress, and the very foundations of liberal democracy.” Rep. Arrington believes the Commission could be the “voice to amplify these mounting dangers.”

State-level UBI could be a better alternative to the existing safety net. Jeffrey Miron, vice president for research at the Cato Institute, argues that a universal basic income (UBI) should replace, not add to, the existing safety net, as the US fiscal path is already unsustainable. He also suggests that replacing programs like SNAP, Social Security, and Medicare with UBI would cut bureaucracy, reduce paternalism, and eliminate policies interfering with the price system, like minimum wage laws and rent control. While some advocate for a federal UBI, believing that the state-by-state approach would lead to a “race to the bottom,” Miron points out that government programs tend to expand over time, and competition between states could maintain a balance. He concludes: “Eliminating all federal redistribution, while allowing states to operate UBI programs, thus implies a smaller, less distorting safety net that would still protect the most vulnerable.”

Good piece.

Except perhaps for the last point: whatever one thinks of the UBI, the idea that it will replace SS in any of our lifetimes is just lunacy.

Almost as bad to suggest it might replace Medicare. That has close to zero chance of happening ever either, but at least it’s less crazy to put out there. And Medicare has no great answers re: how to address, so making it a “voucher” as a part of a UBI system is not an insane discussion.

In reality, if he left SS and Medicare out of the discussion and just chose to talk about UBI replacing all other welfare programs - including Medicaid - that will be more than a tough sell - given that those left of center want UBI to add to existing programs, not replace most (or even any) of them - but at least it’s a conversation that is plausible and worth having.