Sneak Preview: New Study Finds $12 Trillion in Emergency Spending

Six reforms to rein in excessive emergency spending

Contact the authors for additional details regarding our preliminary research.

Congress should reject fiscally irresponsible emergency supplemental spending.

Congress will soon consider emergency supplemental funding bills, including $111 billion in foreign aid for Ukraine and Israel. A separate $56 billion supplemental for domestic issues like childcare and additional disaster relief is also on the table. With deficits at $2 trillion and record-high interest rates, taxpayers cannot afford to go on yet another emergency spending spree.

Emergency spending is exempted from fiscal restraints, including discretionary spending limits and PAYGO/CUTGO requirements for new mandatory spending. Opportunities for spending abuse are ripe. As a category, emergency spending is poorly understood and systemically underestimated. With another emergency spending bonanza just around the corner, we decided to share some preliminary findings from a forthcoming paper that provides the first comprehensive estimates of emergency spending going back to 1992. Here are five key takeaways from our research:

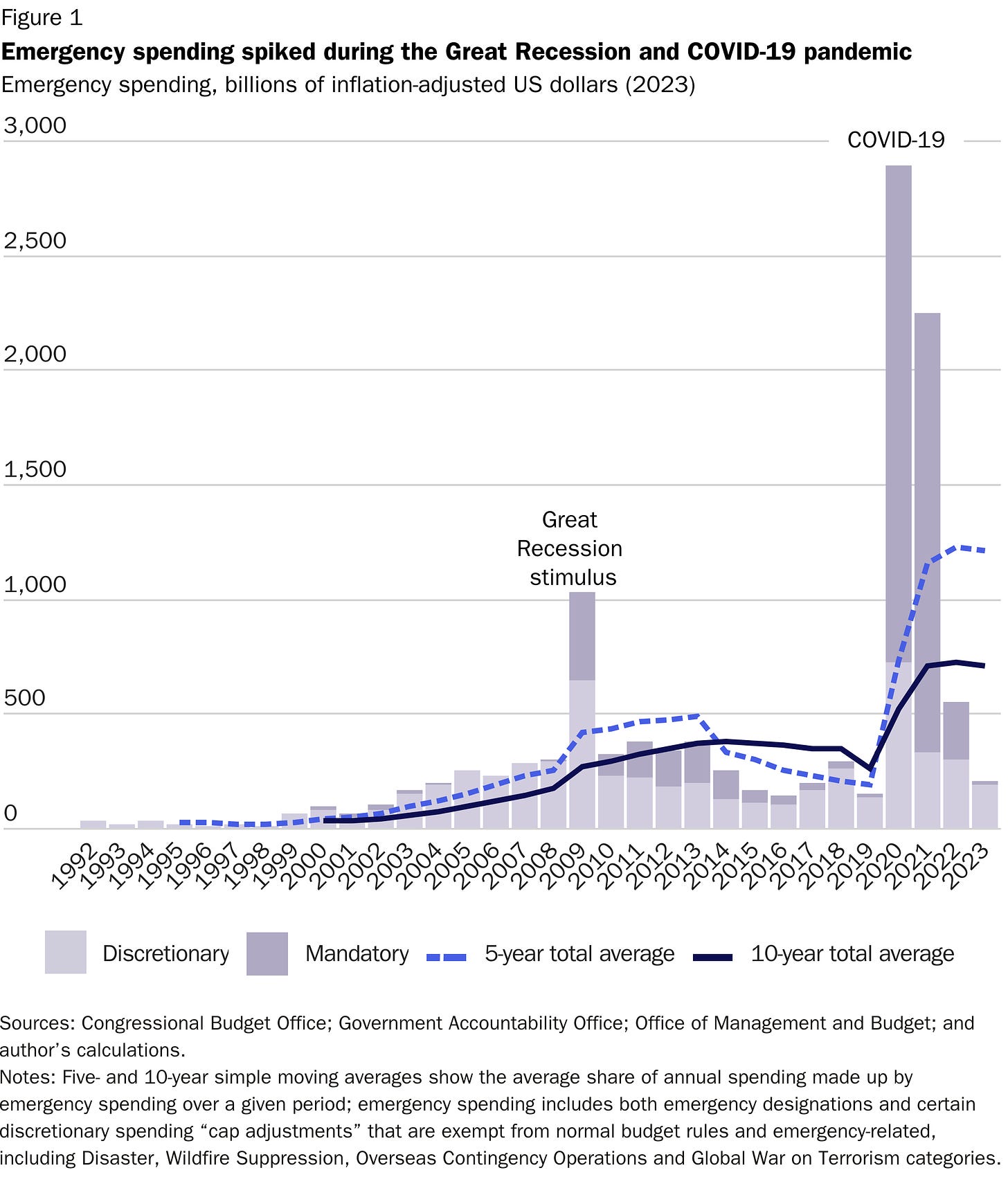

Emergency spending is costly. Congress has designated $12 trillion in inflation-adjusted emergency and related cap-exempt spending over the last three decades (see the graphic below). That’s 43 percent of the current public debt without including interest costs.

Spending on emergency designations and cap-exempt categories is increasing. The budgetary share of emergency spending has grown from one percent of total budget authority in the 90s to ten percent of total budget authority in the last decade.

Emergency spending is split equally between discretionary and mandatory spending. Unlike what many assume, not all emergency spending is discretionary. About half of emergency spending is mandatory. Five Great Recession and COVID-19 pandemic-related laws account for 87 percent of mandatory emergency spending alone. The pervasiveness of emergency spending means reform must be comprehensive to be effective.

The government’s fiscal responses to emergencies have a significant budgetary impact. The two largest increases in federal debt over the last three decades were directly related to extraordinary emergency spending.

Emergency designations are prone to waste and abuse. Congressional emergency spending, especially in supplementals, is subject to significantly less oversight than regular spending. Supplementals are often rushed through the door and include unrelated, non-emergency add-ons.

Supplemental bills are frequently justified based on national security concerns and the latest foreign policy supplemental is no different. As Senate Majority Leader Schumer (D-NY) said on the floor, “I urge every single senator to think where we are at this moment in history. America’s national security is on the line…” Before breaking the bank, legislators ought to consider that fiscal stability is a necessary element of national security. As we explain in the paper:

Federal spending sprees in response to emergencies like World War II, the Great Recession, and the COVID-19 pandemic were only possible because bond markets were willing to take on greater federal debt. If bond markets were unwilling to finance future spending sprees, high debt could constrain the United States capacity to respond to and prepare for real future emergencies. The largest debt and spending increases in the last few decades have been a direct result of temporary emergency spending efforts. Unlike after World War II, recent emergency spending spikes have resulted in sustained and elevated debt.

Good budgetary discipline, such as offsetting emergency spending, is a necessary condition for the government to fulfill its core responsibility of national defense. If Congress continues its bad fiscal practices, the country might not be able to effectively respond to the next real major emergency when called upon.

The United States faces a host of potential future threats, from a rising China to pandemics to climate change to the unpredictable. Real or imagined, some of these threats will undoubtedly be used to justify future emergency spending. If history is any lesson, the next major crisis and its fiscal response could significantly contribute to—and accelerate—America’s fiscal decline. Policymakers should plan ahead now by overhauling the emergency spending process. Fiscal security is national security.

I’ve seen a lot of talk about emergency spending here but this really puts it into perspective! Very excited to see what else there is in store here!