Debt Digest | “Draconian” Cuts, Entitlement Reform, and Balancing the Budget

Links & Fiscal Facts

Here are this week’s reading links and fiscal facts:

Biden’s Medicare reforms fall short. The American Action Forum’s Douglas Holtz-Eakin argues that Biden’s Medicare proposals fail to address the root cause of trust fund insolvency: rising health care expenditures. He argues that Biden’s net investment income tax increase is simply a large tax increase on small businesses. “Far from being a responsible entitlement reform, it is an undisciplined and damaging money grab.” Read Boccia and Adam Michel’s analysis of the executive budget here.

Focus old‐age income support on those with limited means. Brian Riedl highlighted the shortcomings of Biden’s plans for Social Security and Medicare in the New York Times. One reader wrote back: “My wife and I take nearly $40,000 a year in Social Security payments. We sit on a substantial seven-figure liquid net worth…Do we need it? No…Would we be willing to forgo some or all of it? Yes. Should it be means-tested? Absolutely!” Boccia says Social Security’s original purpose was to provide a modest income in support of individuals who lived beyond the age of average life expectancy. “[Instead] the program is now viewed as a universal retirement paycheck program, which was never its intended purpose.”

A constitutional convention to address debt? House Budget Committee Chairman Rep. Arrington (R-TX) has called for an Article V convention since Congress has “failed in its constitutional duty” to be fiscally responsible. Cato’s Walter Olsen argues against the idea of a constitutional convention. It would lack legal guardrails to ensure delegates stay focused on the task at hand, running the risk of a so-called runaway convention that could undermine Americans’ constitutional rights. Former Cato VP Ilya Shapiro thinks those fears are overblown. “There is nothing to lose from an amendments convention because no matter which party controls Congress, the status quo is a runaway federal government.”

End the tax exclusion for employer-sponsored health insurance. Cato’s Michael Cannon, Harvard Professor Jason Furman, and Brian Blase of Paragon Health Institute will explore the impact of the tax exclusion in an upcoming Cato event on March 31st 11 AM to 12 PM MDT. “The tax exclusion is the single largest contributor to compulsory health spending,” explains Cannon. “It fuels excessive health insurance coverage, medical spending, and health care prices and ties health insurance to employment.” You can register to view the event here.

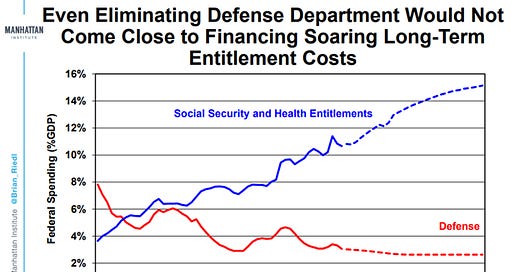

Reform entitlements to slow debt growth. The Congressional Budget Office (CBO) reviewed the spending reductions necessary to balance the budget and found that “if tax cuts are extended and Social Security, Medicare, defense and veterans’ benefits are taken off the table, all other discretionary programs would have to be cut by 100 percent by [2033].” (See a related graph by the Manhattan Institute’s Brian Riedl below).