Debt Digest | US Debt Servicing Costs Outpace Other Mature Market Economies

Links & Fiscal Facts

Here are this week’s reading links and fiscal facts:

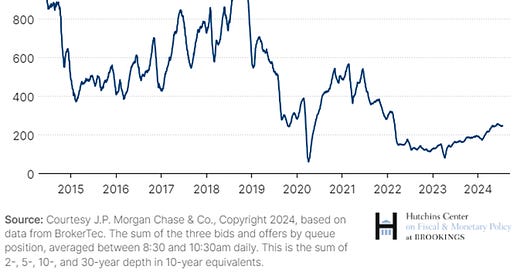

Is the US Treasury having trouble in the bond market? As explained by Brooking’s David Wessel, “Investors bid for newly issued U.S. Treasury debt at auctions knowing that they can sell them easily to other investors in the secondary market. […] In the past few years, there have been a few disruptions to the Treasury market—unusual volatility or a sudden spike in yields—that suggest that at times of stress, the market may not be as liquid as it once was. […] Such episodes underscore that the stock of U.S. Treasuries outstanding is growing faster, while the capacity of banks and dealers to serve as middlemen has been shrinking—in part because of regulations imposed after the Global Financial Crisis that have made that business less profitable.” As shown by the graph below, the health of this secondary market has improved since 2022 but remains below historical averages as measured by one notable metric: market depth (the quantity of Treasury securities that market participants are willing to buy or sell at particular prices). Should Treasury need to suddenly issue more debt, such as during a recession, weaknesses in the secondary market could make it difficult to absorb the new debt. For more on the ways a bond crisis might propagate unexpectedly, see here.

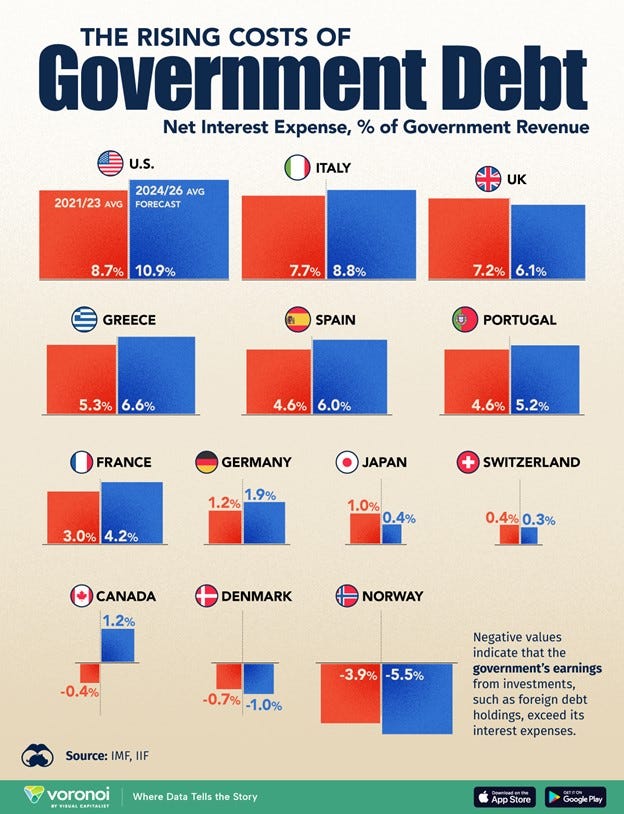

The rising cost of servicing the national debt. Compared to other mature markets, the US leads the way in net interest expenses expressed as a percentage of government revenues, as shown by the Visual Capitalist graphic below. Concerningly, the growth in debt servicing costs as a share of government revenue is expected to outpace even heavily debt-laden economies like Greece and Italy. With interest costs projected to keep growing over the coming years, we have warned that debt’s drag on the economy will increase. “As new consumers and businesses enter the market and as existing loans are refinanced, high interest rates will exert increasing downward pressure on the economy, slowing growth and innovation.”

Entitlements and interest costs are driving the debt crisis. As pointed out by the Committee for a Responsible Federal Budget, the Congressional Budget Office (CBO) projects that spending will grow from $6.8 trillion in 2024 to $10.3 trillion in 2034. “About 87 percent of this increase is due to three parts of the federal budget: Social Security, federal health care programs, and interest payments on the debt.” As I pointed out, the key takeaway is that “major entitlements are driving the US deeper into debt and exploding interest costs in the process.” A well-designed fiscal commission has the best chance of overcoming the entrenched political interests that have prevented serious entitlement reform in the past and putting the US on the right fiscal track.

Harris proposes economically damaging tax increases. Cato’s Adam Michel’s writes, “Vice President Kamala Harris’s campaign recently confirmed that she supports all the nearly $5 trillion in tax increases included in President Biden’s 2025 budget proposal.” Among many other tax increases, such as a 28 percent federal corporate tax rate and 44.6 percent top capital gains and dividend tax rate, “the Harris plan would also increase top federal income tax rates so that combined state, local, and federal tax rates would be on the wrong side of the Laffer curve in 36 states and Washington, DC—the point at which higher tax rates create so much economic distortion that they no longer bring in additional tax revenue. The cumulative economic losses from Harris’s tax hikes will be death from a thousand cuts […] resulting in lower wages for American workers and slower economic growth.”

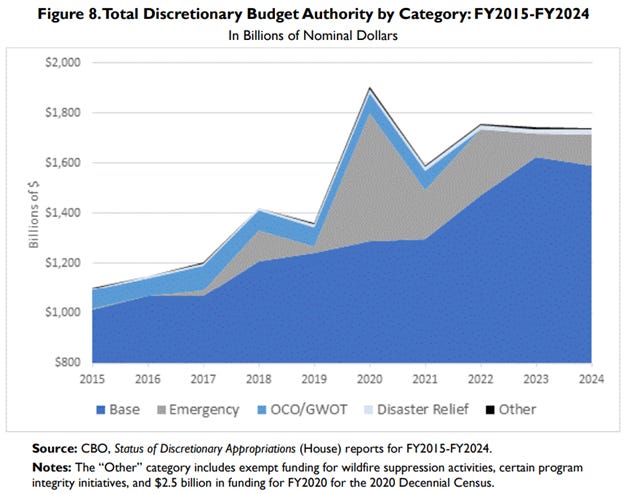

Discretionary spending is on the rise. Per a new report by the Congressional Research Service, “Current law allows Congress to designate discretionary budget authority for multiple purposes (‘adjustment categories’) that are exempt from budget enforcement procedures. This has included spending for purposes Congress designates as being for emergency requirements, Overseas Contingency Operations/Global War on Terror (OCO/GWOT), disaster relief, certain “program integrity” initiatives, wildfire suppression activities, and the decennial census. […] As Figure 8 shows, exempt spending is large enough to change the overall pattern of spending increases in the past 10 years.” As we’ve previously argued, “Congress has overleveraged the emergency spending category following the adage to ‘never let a good crisis go to waste.’” Check out an assortment of promising emergency spending reform proposals here.