Debt Digest | Trump’s Tariffs Won’t Pay for Tax Cuts in the “One Big Beautiful Bill”

Links & Fiscal Facts

Here are this week’s reading links and fiscal facts:

Raise the Social Security retirement age. In response to the aging population and the fiscal pressures that come with it, Denmark recently raised its retirement age to 70 for workers born in 1971 or later (those aged 54 or younger in 2025). Notably, Denmark has indexed its government pension retirement age to life expectancy since 2006—a model the United States should follow. As we discuss in our upcoming book, Reimagining Social Security: Global Lessons for Retirement Policy Changes, many OECD countries are actively countering demographic pressures by adopting similar changes. However, as the Wall Street Journal editorial board puts it: “[The] U.S. system of Social Security is projected to be insolvent in 2033, at which point the checks to retirees will suddenly be 21% smaller. Nobody wants this to happen, but nobody wants to take the heat for proposing real reform, so the U.S. keeps barreling toward a cliff while pretending not to notice.”

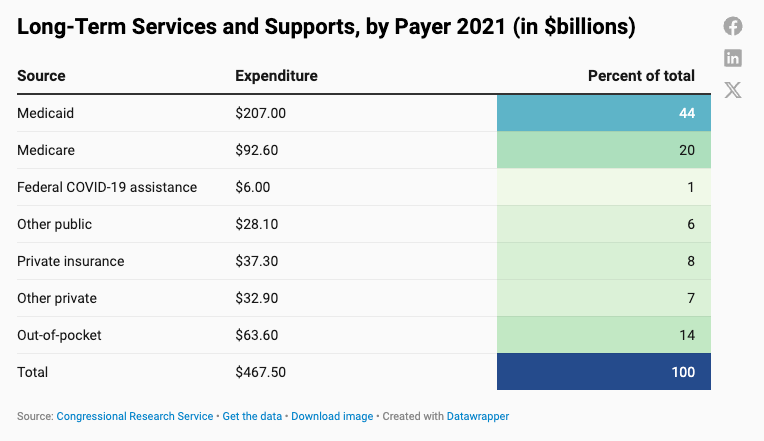

Long-term care costs aren’t driving a retirement crisis. American Enterprise Institute’s Andrew Biggs critiques a Morningstar report that projects 41 percent of households will run out of money in retirement when long-term care costs are included. He highlights a critical flaw in the report’s methodology: it assumes retirees cover nearly all of their long-term care costs themselves. Biggs points to a Congressional Research Service analysis that shows seniors paid only 14 percent of long-term care costs out of pocket, or only 2 percent of their total incomes, in 2021. As the table below illustrates, of the $468 billion in total long-term care spending in 2021, government programs such as Medicaid and Medicare covered $334 billion (71 percent), private insurance and other private sources covered $70 billion (15 percent), and the rest ($64 billion) was paid out of pocket. Biggs concludes: “[T]he Morningstar analysis doesn’t point toward Americans facing a retirement crisis. If anything, it indicates the opposite.”

Tariffs won’t pay for tax cuts. In a Washington Post op-ed, Cato’s Scott Lincicome outlines six reasons why President Trump’s tariffs won’t pay for the tax cuts in the GOP budget bill. First, tariffs are implemented via executive action and can be easily reversed by the next administration. Second, Trump’s tariffs are already challenged in courts, and adverse rulings like the one from the Court of International Trade last week could wipe out trillions in revenues. Third, Trump uses tariffs as a negotiation tool and frequently reverses them, making them an unreliable source of revenue. Fourth, the administration will likely exclude some products from tariffs, like it is already doing with consumer electronics, which will further reduce revenues. Fifth, tariffs dampen economic growth and reduce tax revenues. Lastly, high tariffs will encourage both legal and illicit efforts to circumvent them. As Lincicome concludes: “Reasonable minds can differ on the direction of future U.S. tax or trade policy. But Congress should pursue both with honesty and pay for its tax plans by closing loopholes and cutting federal spending, not turning to fantasy sources of revenue.”

Congress shouldn’t adopt a new senior tax deduction. The House’s tax-and-spending bill includes a temporary (2025-2028) $4,000 additional deduction for seniors aged 65 or older, a watered-down version of Trump’s “no tax on Social Security” campaign promise. As the Wall Street Journal’s Ashlea Ebeling and Richard Rubin note: “This version significantly limits the revenue loss, clocking in at about $18 billion a year instead of about $100 billion for a full exemption.” However, even $18 billion is too much. Seniors— who are wealthier than younger workers—already receive an additional $2,000 deduction. There is no sound policy reason to give them additional tax subsidies beyond the political incentive to give a tax break to a demographic that turns out reliably at voting booths. As Cato’s Adam Michel argues, these kinds of targeted tax subsidies should be scaled back or repealed, and replaced with pro-growth reforms—like making full expensing for equipment, machinery, and research costs permanent.

Rising federal debt erodes the global status of US Treasuries. David H Levey, former managing director for sovereign ratings at Moody’s, weighed in on the agency’s recent downgrade of US debt: “In my view, Moody's is correct to conclude that, from today's vantage point, the debt burden has finally reached the point of more than offsetting the continuing special attractiveness of U.S. Treasuries as the world's premier ‘safe asset.’” Levey also notes that it’s not the tax side but excessive spending, primarily on entitlement programs, that drives rising federal deficits. As Boccia has written on the Moody’s decision: “It’s time for Congress to set up an independent fiscal commission—a Budget Realignment and Control Commission or fiscal BRAC—to initiate the economically necessary but politically difficult entitlement and tax loophole reforms that are long overdue.”