Debt Digest | Trillion Dollar Interest Payments

Links & Fiscal Facts

Here are this week’s reading links and fiscal facts:

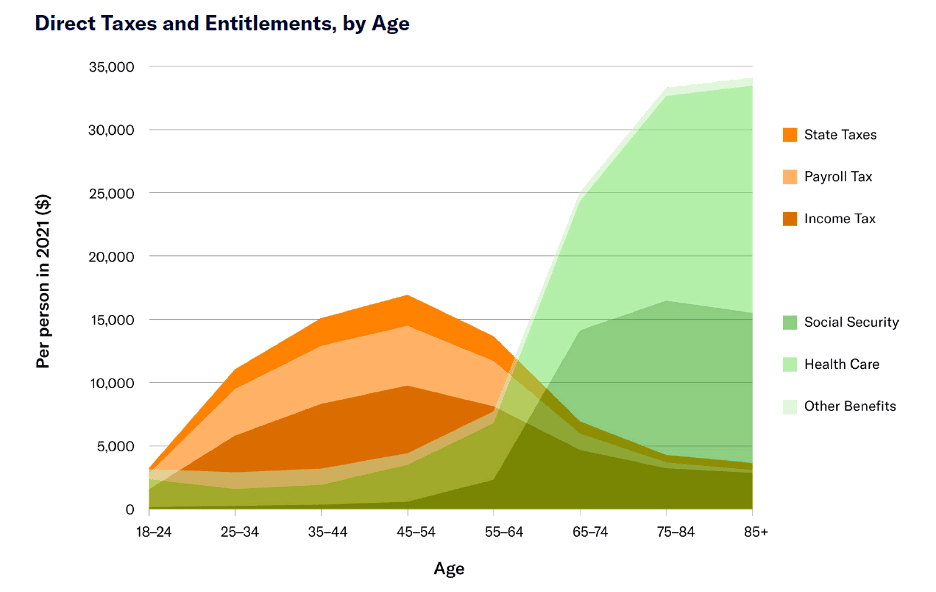

What is Total Boomer Luxury Communism (TBLC). Russ Greene of the Prime Mover Institute explains in The American Mind: “The essence of TBLC is that it redistributes wealth from younger families and workers to seniors, who are on average much richer.” He shares a graph from Chris Pope to illustrate the magnitude of the tax and transfer. Greene elaborates, “There’s six times as much wealth redistribution happening in America as in China. That’s the “communism,” but only for the “Boomers.” The “luxury” part comes in how the government distributes these benefits.” This “luxury” includes “Social Security benefits [that] can reach over $60,000 per person,” and “Medicare programs [that] cover golf balls, greens fees, social clubs, ski trips, and horseback riding.” Boccia has been highlighting how Social Security operates on the Robin Hood principle in reverse and she and her co-author Nachkebia urge Congress to rethink Social Security in their new book, Reimagining Social Security: “Policymakers should consider fundamentally rethinking the program’s structure and transform it into a system that ensures seniors are protected from poverty when they can no longer work, while also freeing up resources for younger workers to save more on their own.”

Americans’ misunderstanding of Social Security makes reform more difficult. On the Cato Podcast, Romina Boccia and Emily Ekins unpack a new Cato–YouGov poll showing that while 83 percent of Americans have favorable views of Social Security, nearly half don’t realize it’s a pay-as-you-go program in which today’s workers fund today’s retirees, not their own future benefits. Many mistakenly think they have something like a personal savings account, yet 70 percent still expect benefit cuts and a third doubt the program will even exist when they retire. The episode walks through the public’s resistance to big structural reforms, the surprising openness to slower benefit growth and flat anti-poverty benefits once tradeoffs are explained. Boccia and Nachkebia highlight the finding that once respondents understand the tradeoffs involved, “71% of respondents favor creating a commission of independent experts to address Social Security’s funding shortfalls.”

COVID-era Obamacare subsidies crowd out employer-provided plans. Chris Pope of the Manhattan Institute explains in WSJ: “The ACA’s original subsidies were on average worth $293 (5%) less to households than the value of the tax exemption for employer-sponsored insurance, the expanded subsidies would be worth $3,960 (65%) more. That creates a huge incentive for employers to stop offering health benefits. […] If all employees currently receiving employer-sponsored benefits switched, these higher subsidies would cost federal taxpayers an additional $250 billion a year.” Cato’s Adam Michel emphasizes how the subsidies pour money into low-value insurance: “without the expanded COVID-19 subsidies, 3.8 million Americans would choose not to purchase insurance in 2035 and instead spend their money on something they value more.” Employers respond to the subsidized ACA plans and “have already begun to cut offers of health insurance. From 2019 to 2025, the share of companies with 50 or more workers offering benefits declined from 94% to 91%, and the proportion of those with 10 to 49 workers fell from 67% to 54%.” Pope concludes, “The expanded subsidies greatly exceed what’s needed to stabilize the individual market. If you like the health-insurance plan you receive from your employer, you may not be able to keep it.”

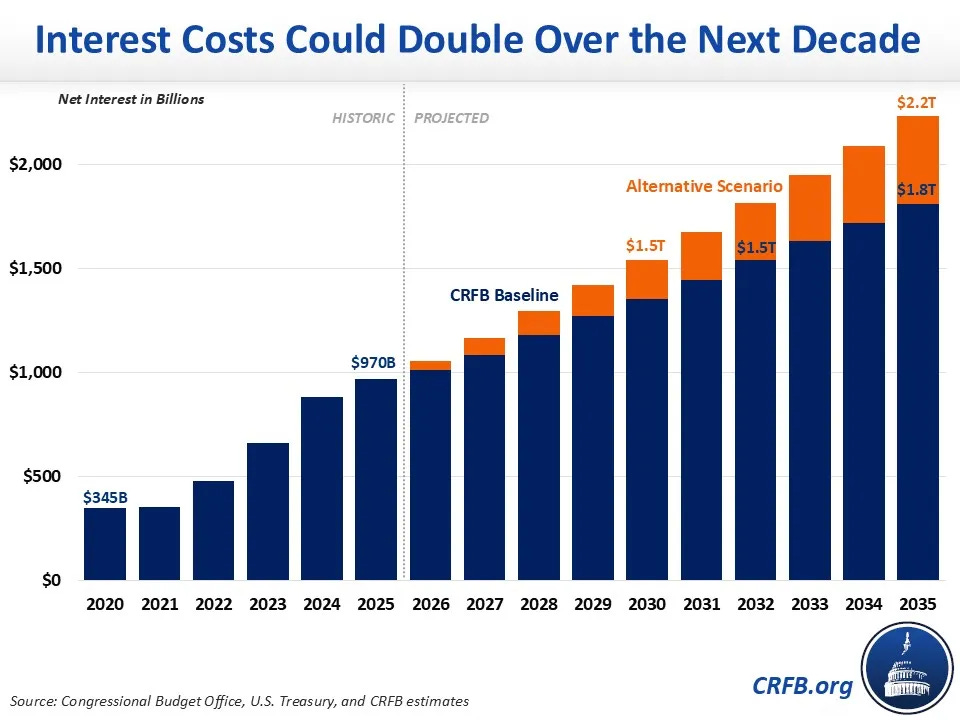

The federal government will pay over a trillion dollars in interest every year for the next decade. A new Committee for a Responsible Federal Budget report demonstrates the alarming situation, as “interest payments on the public debt surpassed $1 trillion for the first time in FY 2025. Over the coming decade, we project that these figures will only rise, with interest payments surpassing $1.5 trillion in 2032 and $1.8 trillion in 2035.” Boccia emphasized the threat of the rising interest payments in a testimony for the House Budget Committee last December: “As interest payments on the national debt consume an ever-larger share of federal revenue, they divert resources from core responsibilities of the federal government, including national defense. In 2024, net interest payments exceeded federal spending on discretionary defense appropriations—an alarming milestone that underscores the trade-offs imposed by fiscal irresponsibility.”

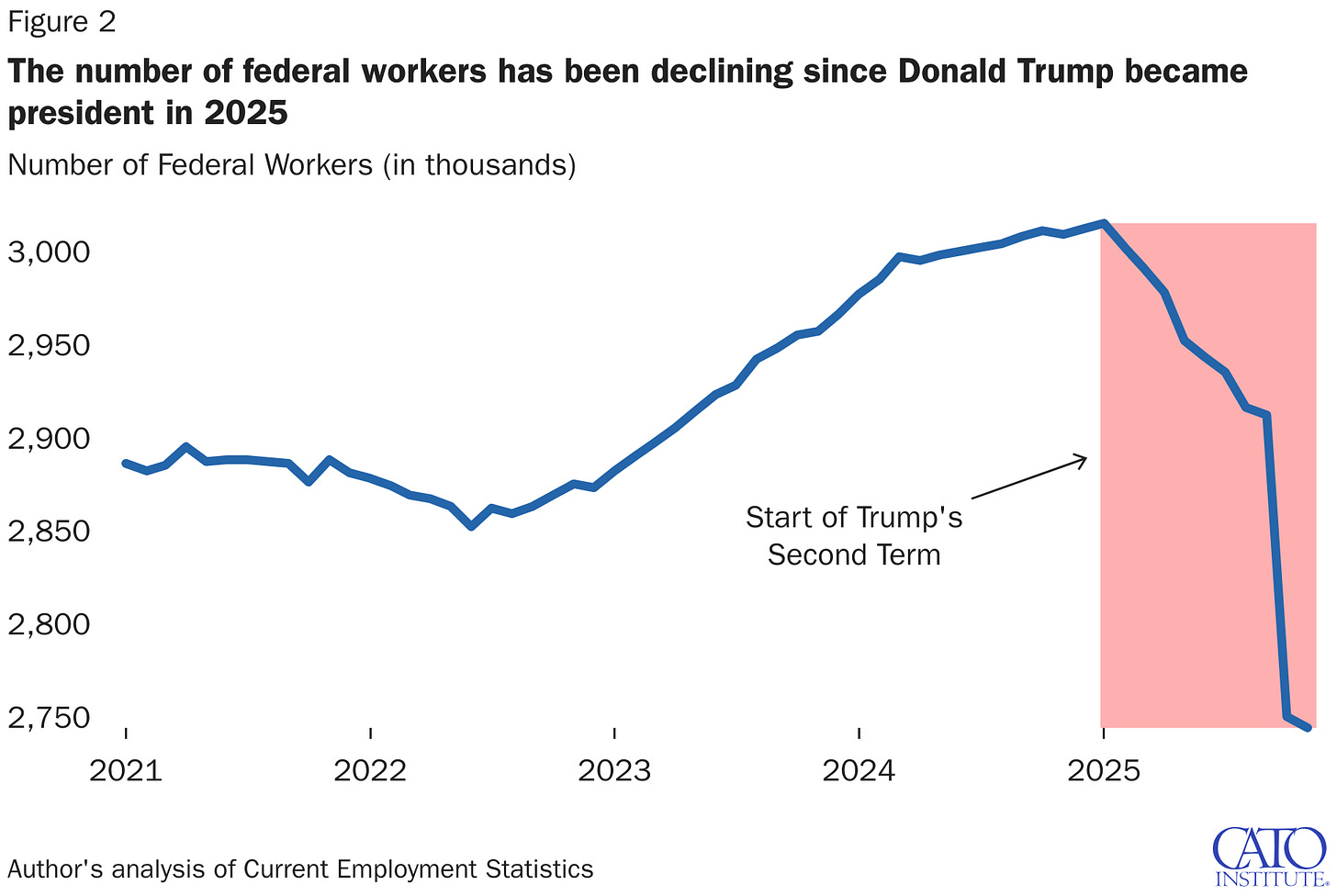

DOGE cut the federal workforce, but federal spending only increased. Cato’s Alex Nowrasteh and Krit Chanwong write in Cato at Liberty: “DOGE did not reduce spending, but it did reduce federal employment by nine percent in less than 10 months. A decline that large has not happened since the military demobilizations at the end of World War II and the Korean War.” DOGE “sizably cut federal employment by 271,000 [see figure below]. That’s a nine percent decline since January 2025. They stipulate, however, that “it is not surprising that such a large reduction in the federal workforce did not lead to lower outlays, since most federal expenditures are transfer payments rather than salaries. According to Cato’s report to the DOGE Commission last year, a 10 percent cut in the federal workforce would only save about $40 billion annually.The 3.8 million federal defense and nondefense employees, excluding postal workers, account for around 8 percent of total spending.” In order to seriously reign in federal spending by addressing entailment programs, Nowrasteh and Chanwong point to Boccia’s proposal of BRAC-like fiscal commission.