Here are this week’s reading links and fiscal facts:

Economic growth won’t save the U.S. from mounting debt. GOP presidential candidate Vivek Ramaswamy has said he’ll focus on growing the U.S. economy to deal with high and rising national debt. As Nick Gillespie explains, the “CBO [Congressional Budget Office] estimated that for every 1.2 percentage points that GDP [Gross Domestic Product] exceeds its projected level for 2033, the deficit would be $51 billion smaller in that year…if GDP growth ran 4 percent instead of [the projected] 2 percent over those eight years, the projected deficit in 2033 of $1.4 trillion would be cut roughly in half…In other words, the government would still be running deficits every year, and the federal debt would keep growing.” Boccia and I explain why the government’s worsening fiscal situation harms the economy here.

Federal health care spending triples. CBO’s Julie Topoleski highlighted health care spending trends. “Since 1960, [health care spending] has more than tripled as a percentage of gross domestic product (GDP) [from 5% to 18%].” Federal spending on major health care programs is projected to increase by more than $1 trillion over the next decade, from 4 percent of GDP to more than 5 percent of GDP, primarily driven by growth in Medicare spending.

Fix Medicare to fix our fiscal future. Cato’s Romina Boccia and Millennial Debt Foundation’s William Glass argue that the U.S. cannot tax its way out of unsustainable entitlement spending. They highlight several Medicare reform proposals which allow politicians to spare beneficiaries while attacking runaway costs, such as reducing risk factor adjustments to Medicare Advantage Plans and increasing price competition for drugs paid through Medicare Part B. When the Medicare Hospital Insurance (Part A) trust fund ledger goes to 0 by 2031, inpatient providers will face a reimbursement cut of 11 percent. “Rejecting reform now is choosing chaotic program-slashing later.”

Work requirements for welfare are quite popular. “Last month, almost 80 percent of voters in Wisconsin approved a ballot initiative calling for work requirements on all taxpayer-funded welfare programs for able-bodied recipients without children,” writes the American Enterprise Institute’s Robert Doar. The referendum result is particularly notable given House Republicans’ support of tightened work requirements in the Limit, Save, Grow Act. Boccia and Chris Edwards argue that enhanced work requirements are a good start to reforming welfare programs.

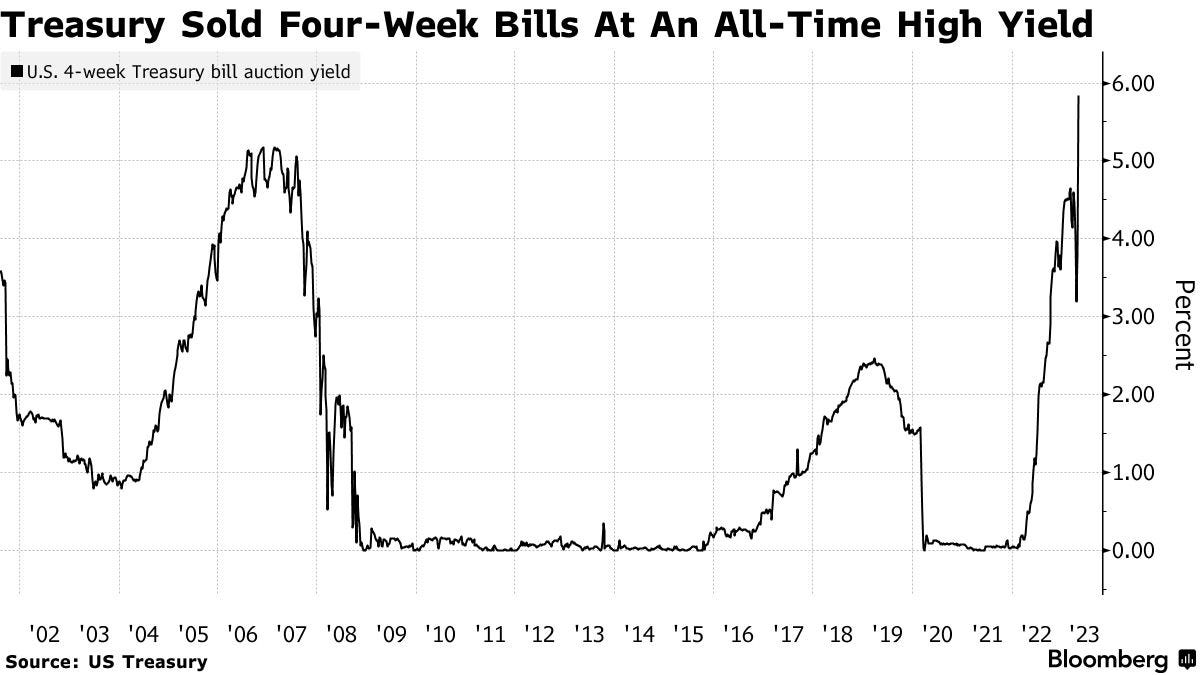

Investors are becoming concerned about the U.S. debt limit. “The government [last Thursday] sold $50 billion of four-week securities at a record 5.84%. That’s the highest for any Treasury bill issue since 2000. The new securities are scheduled to mature on June 6,” writes Bloomberg’s Alex Harris. The graph below shows historical yields for four-week Treasury bills over the last 20 years. Boccia argues that “the responsible choice at the debt limit is for Congress and the executive to reduce government deficit spending and slow the growth in the debt.” See her proposal for a BRAC-like fiscal commission which could help stabilize the debt here.