Here are this week’s reading links and fiscal facts:

Social Security should protect seniors from poverty. Democrat’s Social Security Expansion Act adds $33.8 trillion in higher taxes. Heritage’s Rachel Greszler writes that “tax hikes on workers, savers, investors, and small business owners would distort positive activities and cause significant economic damage.” Instead, she argues that “policymakers should preserve the program and improve incomes and economic growth through a targeted structure that increases benefits for the lowest earners and allows workers the opportunity to build wealth that they own and can pass on to their families.” Boccia similarly argues that Social Security should be transformed into a means-tested program here.

America’s tax and entitlement system is highly progressive. The Tax Foundation found that “The lowest quintile [of income earners] experienced a combined tax and transfer rate of negative 127.0 percent, meaning that for each dollar they earned, they received an additional $1.27 from the government, netting transfers (gains) and taxes (losses), while the top quintile had a rate of positive 30.7 percent, meaning on net they paid just under $0.31 for every dollar earned.”

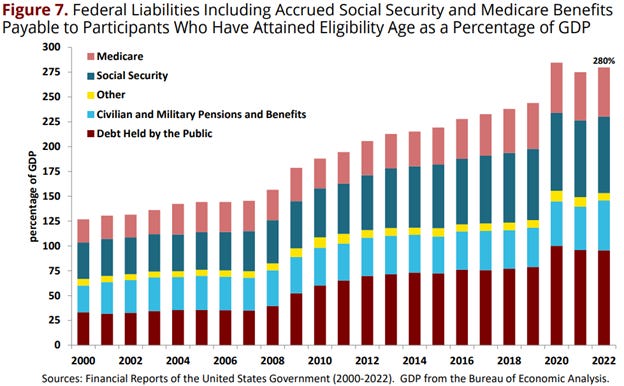

Accounting for Social Security and Medicare obligations. Texas A&M’s Dennis Jansen and Andrew Rettenmaier explain that the debt held by the public (currently 96% of GDP) is but one type of federal liability. Adding Social Security and Medicare benefits, federal employee retirement liabilities, and other federal liabilities produces a total liability measure of $71.1 trillion or 280% of GDP. Total federal liabilities represents how much the government owes across federal government programs (Figure 7). Since Social Security and Medicare are not liabilities “in a legal or accounting sense,” the government does not include them on their official balance sheet. Jansen and Rettenmaier argue that “all the Government programs that [promise benefits] should be accounted for similarly.” Boccia writes about the related financing issue of unfunded obligations (the present value of scheduled future benefits less the present value of the dedicated future tax revenues) here.