Here are this week’s reading links and fiscal facts:

Higher taxes won’t save Social Security. Some lawmakers have proposed raising the payroll tax cap which is currently indexed to national average wages. For earnings in 2023, the taxable maximum is $160,200. As Travis Nix argues, the increase in revenue would hurt economic growth while only delaying insolvency for a few years. The proposal would “directly reduce people’s take-home pay, decreasing the incentive to work and pushing some of the most innovative workers out of the economy.” For comparison, most European countries cap taxes at much lower incomes (e.g., the Netherlands cap social security payroll taxes at $40,370). Congress should focus on policies which promote long-term solvency and allow for greater economic growth. Read Boccia’s commonsense recommendations here.

Medicare’s financing mess hides the program’s true cost. Medicare’s Hospital Insurance trust fund will be exhausted by 2028. C. Eugene Steuerle from the Tax Policy Center summarizes Medicare’s complex web of 15 different revenue streams. Were Medicare to use a single source, “it would take the payroll tax devoted to both Social Security and hospital insurance benefits to cover the cost of Medicare alone” by the end of the 2030s. Another way the federal government obscures the full cost of Medicare is by reporting net spending minus offsetting receipts. Cato’s Chris Edwards describes this practice as “a sneaky way for Washington to hide some of its massive footprint.”

State government’s high reserves could cushion a recession. David Harrison of the Wall Street Journal writes “states will hold an estimated $136.8 billion in rainy-day funds this fiscal year.” “If the economy weakens, the federal government should not bail out the states,” argue Cato’s Chris Edwards and Ilana Blumsack. “State governments have large and independent fiscal powers, and they can handle crises and downturns on their own.” Read more about state budgeting here and here.

$191 billion in misspent Covid-19 unemployment benefits. “Top watchdogs told the House Ways and Means Committee that they still cannot compute the total amount of federal covid aid subject to fraud and abuse,” reports the Washington Post’s Tony Room. Inspectors general from multiple agencies have corroborated accounts of wasteful emergency spending. Read Boccia and my recommendations for putting limits around emergency funding abuses here.

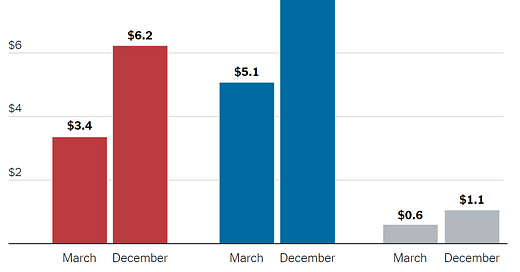

Ban earmarks to curb excessive spending. As Stephanie Lai of the New York Times explains, earmarks—now rebranded as community project funding—direct federal money to lawmakers’ pet projects. The chart below shows how “earmarks requested by members of both parties skyrocketed over the last year.” Boccia argues that earmarks bypass statutory formulae and competitive award processes to curry favors with voters and special interest groups. “Such a misdirected focus inevitably invites fraud, waste, and abuse.” Congress should restore the earmark ban now.