Here are this week’s reading links and fiscal facts:

Debt projected to reach record highs. The Congressional Budget Office’s 10-year budget projections estimate that public debt will reach 119 percent of gross domestic product (GDP). According to the Committee for a Responsible Federal Budget (CRFB), if discretionary spending grows and expiring policy provisions, like tax cuts, are extended, debt reaches 133 percent of GDP. Combined with pessimistic economic assumptions, CRFB projects that debt will reach 141 percent of GDP. Boccia and I discuss key trends outlined in the CBO’s budget projections here.

Trillions in savings required to balance the budget. CRFB reports that it would take $16 trillion in deficit reduction to balance the budget over the next decade. Stabilizing debt at the current level of GDP (97.5 percent) would require $8.4 trillion in savings. A Better Budget Control Act could generate the necessary savings to stabilize the debt through limits on discretionary spending, mandatory spending cuts, and reforms to Social Security and Medicare put forth by an independent commission.

Sleepwalking towards fiscal disaster. “Almost two-thirds of the nation’s fiscal imbalance is the result of policy choices made more than 50 years ago,” according to research by Charles Blahous. Social Security and Medicare spending occur automatically and are not subject to annual appropriations. That means that lawmakers would need to pass new laws to restrain spending in major entitlement programs, making it harder to fiscally course correct. Boccia describes the failure to internalize the true cost of public policies as fiscal illusion. “Government programs appear less costly to taxpayers than they are because the current generation bears only part of the burden.”

Fortifying the federal budget against future emergencies. R Street’s Jonathan Bydlak highlights the rise of emergency spending and several promising reform proposals. Boccia argues that Congress should adopt notional emergency spending accounts to track and enforce offsetting spending reductions. Read more here.

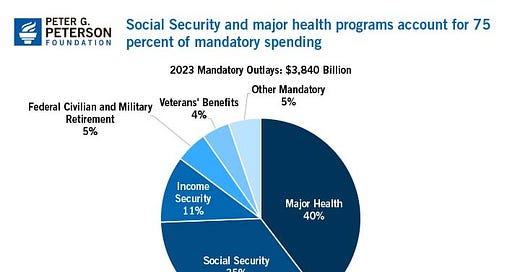

Entitlements dominate federal spending priorities. According to the Peterson Foundation, entitlements occupy four of the top five largest federal budget functions. Most entitlement spending is mandatory, meaning it occurs automatically according to statutory formula (see the graph below for a breakdown of mandatory spending by category). Among the five largest federal budget functions, only national defense is subject to regular review and spending limits.