Here are this week’s reading links and fiscal facts.

Government shutdown is theater over substance. The current budget year (FY2023) ends on September 30th. Without a short-term budget measure, the government could “shutdown” on October 1st. “The good news here is that any shutdown is unlikely to last long. So no big economic impact and little market reaction, probably,” writes James Pethokoukis of the American Enterprise Institute. “[T]he whole exercise looks performative rather than substantive. If you care about the long-term fiscal trajectory of the federal government, then you should be engaging on issues such as entitlement reform, creating a tax code that raises more revenue efficiently, and policies to increase the economy’s productive capacity.”

Cut farm bill subsidies. Congress will soon debate the farm bill with 10-year costs upwards of $1.5 trillion. Farm subsidies should be cut, not expanded. “One option on the table is imposing tighter income limits on crop subsidies, which are currently paid to many high‐income landowners,” Cato’s Chris Edwards writes. Another option is allowing states to cut junk foods from SNAP—the largest federal food stamp program. Read more about farm subsidies here and SNAP here.

Reform the Consumer Financial Protection Bureau. The National Taxpayers Union spotlights 10 taxpayer wins in House appropriations bills. One such reform in the Financial Services and General Government bill would make the Consumer Financial Protection Bureau (CFPB) subject to the appropriations process. Currently, the CFPB sidesteps the normal appropriations process and receives funding directly from the Federal Reserve. “Short of abolishing the CFPB, Congress should place the CFPB within the congressional appropriations,” Cato’s Norbert Michel argues. He suggests other financial reforms here.

Deficits balloon despite economic rebound. The Committee for a Responsible Federal Budget (CRFB) projects the federal deficit will double to $2 trillion this year. That comes despite the U.S. economic outlook improving. Taxpayers for Common Sense explains, “High deficits during prosperous periods prevent the government from saving or at least reducing the debt relative to GDP. Historically, government spending increases during economic downturns due to greater demand for safety net programs like unemployment and Medicaid as well as increased spending to stimulate the economy or both. If we’re already struggling financially during peak times, our options during crises could be limited.”

Gross debt to hit 129 percent of GDP by 2033. The Congressional Budget Office (COB) projects that gross federal debt—debt held by the public and intragovernmental debt held by government accounts such as Social Security’s trust fund—will reach 129 percent of gross domestic product (GDP) by 2033 and 192 percent of GDP by 2053. “[I]f current laws governing Social Security’s taxes and benefits did not change, the combined Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) trust funds would be exhausted in fiscal year 2033.” That would result in an average benefit cut of 23 percent. Better to reform entitlements sooner, before more gradual policy options expire.

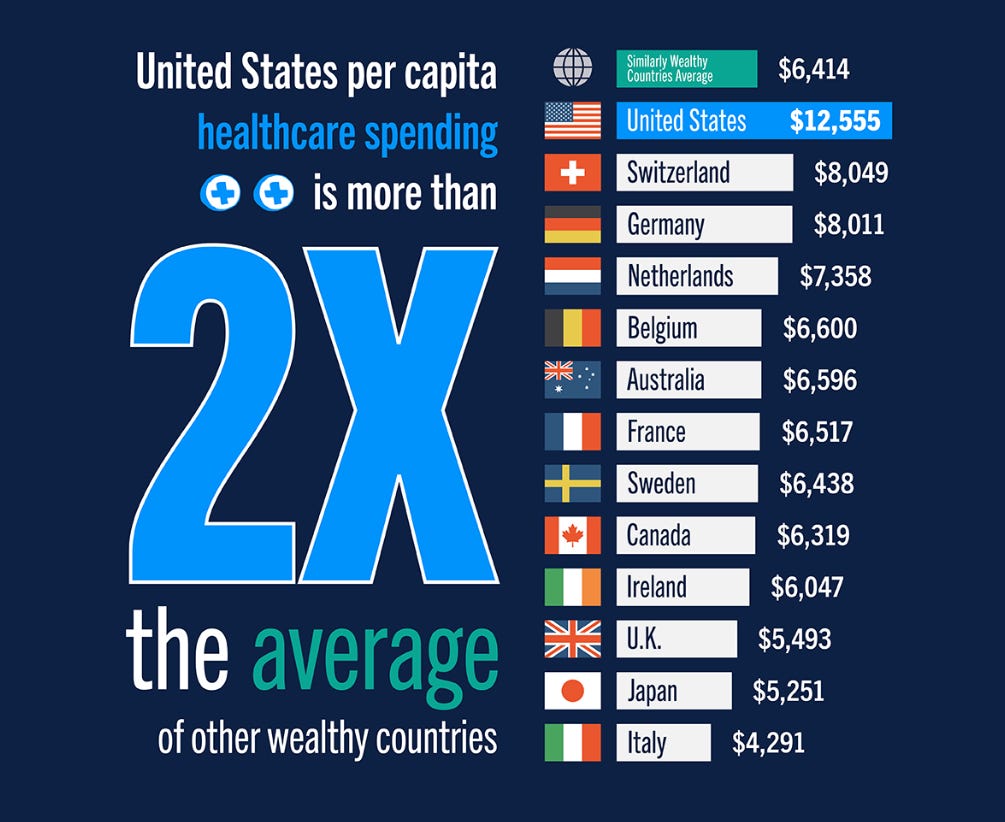

Rising healthcare spending worsens fiscal outlook. Healthcare costs are a key driver of the U.S. national debt. As the Peterson Foundation reports, U.S. healthcare spending per person is two times that of other wealthy countries (see the graphic below). Yet, the U.S. experiences no better or worse health outcomes. “Medicare subsidies encourage the consumption of low‐value care…[One research estimate suggests] that one‐third or more of Medicare spending provides no value whatsoever.” Cato’s Michael Cannon argues that applying “public option” principles to Medicare and offering beneficiaries cash benefits would result in cost savings. “Enrollees would spend that money better than government bureaucrats do. Evidence shows that cost‐conscious patients force providers to reduce prices.”