Here are this week’s reading links and fiscal facts.

Pandemic spending spree and its consequences. In a comprehensive look at pandemic spending, David Ditch and Richard Stern of the Heritage Foundation tally $7.5 trillion in additional spending between 2020 and 2022. “Opportunistic legislators from both parties used the crisis as cover for massive handouts to political constituencies, counterproductive expansions of welfare programs, and a variety of ill-conceived slush funds for state and local government entities…the commitment to tremendous new spending programs and central bank money-printing steered the economy into a devastating inflation spiral and a shaky recovery while also enabling (and implicitly encouraging) further lockdowns through intergovernmental subsidies and lengthy welfare expansions.”

Fiscal feedback loops. George Mason University professor Arnold Klein explains, “At some point, the U.S. will go into a doom loop: to pay for interest on the debt, the government will have to issue more debt; this will fuel inflation, and interest rates are likely to rise; this will force interest payments even higher. This year, with interest rates elevated to previous years, we may have already entered the doom loop.”

F-35 costs grow. The Department of Defense plans to procure nearly 2,500 F-35s to the tune of $1.7 trillion over the program’s lifetime. “[E]stimated costs to sustain the F-35 aircraft have grown since 2012, exceeding estimates by hundreds of millions of dollars,” according to the Government Accountability Office (GAO). Most of the increased “life cycle” costs are associated with maintenance. As of March, F-35s were only capable of performing tasked missions half of the time. GAO identifies “heavy reliance on contractors at the depot level” as one cause of maintenance failures. Read more about how lobbying influences defense spending and strategy here.

House Republicans unveil balanced-budget plan. The proposed House budget resolution proposes reducing deficits by $14.4 trillion over 10 years—mostly through spending cuts and optimistic economic assumptions. As the Committee for a Responsible Federal Budget explains, “The document represents the first budget resolution to be proposed and considered by the House Budget Committee since FY 2019. The Senate Budget Committee has not proposed and considered a budget resolution since FY 2020.” According to House Budget Chairman Jodey Arrington, “Our muscle as Republicans for fiscal responsibility has atrophied over the years, and we’re trying to rebuild that…[marking up the budget plan would] encourage at a minimum the debate about what that path forward into a more sustainable fiscal future looks like.” Boccia argues that withholding congressional pay would add extra incentive to adopt future budget resolutions and “encourage members to grapple with the size and scope of federal spending and to put their policy priorities into the context of fiscal realities.”

Establish a fiscal commission. Entitlements are driving our country toward fiscal disaster, but political considerations have prevented meaningful reform. As House Budget Chairman Arrington points out, “We do the only realistic thing to actually solve [entitlements]…put it in a commission of sorts, where you have both parties who are serious about coming to a consensus in order to save it and strengthen it going forward.” Bloomberg Government reports that Arrington told colleagues that broader spending reforms for major entitlement programs — not the smaller annual government-funding bills — “will ultimately save the country from a debt crisis.” Boccia agrees writing, “As Washington tinkers around the edges of the behemoth federal budget, members are steering clear of the biggest budget items—the ones sending U.S. debt to unprecedented heights…To avert a future fiscal crisis, Congress should empower a nonpartisan fiscal commission designed after the Base Realignment and Closure process (BRAC).”

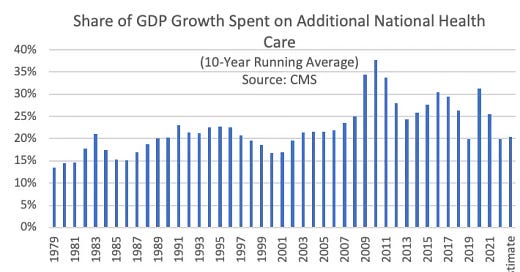

Are health care costs slowing? As the New York Times reports, “After decades of rapid growth, Medicare spending per beneficiary has flattened out.” No one is sure why. However, the Urban Institute’s Eugene Steuerle warns, “The jury is still out on whether health cost growth is slowing, by any measure. The movement of surviving baby boomers into their 80 and 90s won’t help. The danger is that the prediction of slower growth can easily lead Congress further to avoid its job of budgeting, hence making the prediction the source of its own failure.” The graph below shows the share of GDP growth dedicated to additional total national healthcare over different ten-year periods. As Steuerle argues, “[O]ne of the better ways to assess health cost growth is to look at what share of the growth in national income or GDP it absorbs.”