Here are this week’s reading links and fiscal facts:

Questions Congress should pose to Fed Chair Powell. As Federal Reserve Chair Jerome Powell heads to Capitol Hill on Tuesday and Wednesday for his semiannual testimony, the stakes are particularly high. With debt surging, these upcoming hearings present crucial opportunities for Congress to ask forward-looking questions about the specter of fiscal dominance in the US. Here are some questions Congress should pose to Fed Chair Powell:

With the debt-to-GDP ratio at historically high levels and growing, how does the Federal Reserve assess the risks the national debt could pose to economic stability, and what are the potential implications for future monetary policy actions?

How does the Federal Reserve assess the risk of fiscal dominance, where fiscal policy constraints influence monetary policy decisions? How could Congress lower those risks?

In your view, what role should fiscal responsibility play in maintaining price stability, and how can the Fed and Congress best work together to control inflation?

Here are some background resources for congressional offices trying to make sense of the dual threats of unsustainable spending, driving up the US debt, and higher inflation.

High and rising debt increases the risk of fiscal dominance, where monetary policy serves fiscal ends, endangering central bank independence. Historical examples like post-WWI Germany and contemporary Argentina show that fiscal dominance leads to severe inflation and economic decline. Legislators must address the drivers of federal deficits, including entitlement spending, to maintain US financial credibility.

CBO Warns of Fiscal Crisis in Long‐Term Budget Outlook

The Congressional Budget Office's 30-year budget projections reveal an alarming rise in debt, deficits, and interest costs, primarily driven by unsustainable spending on Medicare and Social Security. Legislators must heed these warnings and implement significant fiscal reforms to avert a future economic crisis.

Another CBO Report Warns of Debt Surging, As a Fiscal Crisis Brews

High debt levels risk triggering a debt doom loop, where rising interest rates lead to more borrowing and further interest costs, potentially causing a fiscal crisis. Historical examples like the 2009 Greek debt crisis and the UK's 2022 bond market turmoil show how sudden shifts in investor confidence can escalate into severe economic instability.

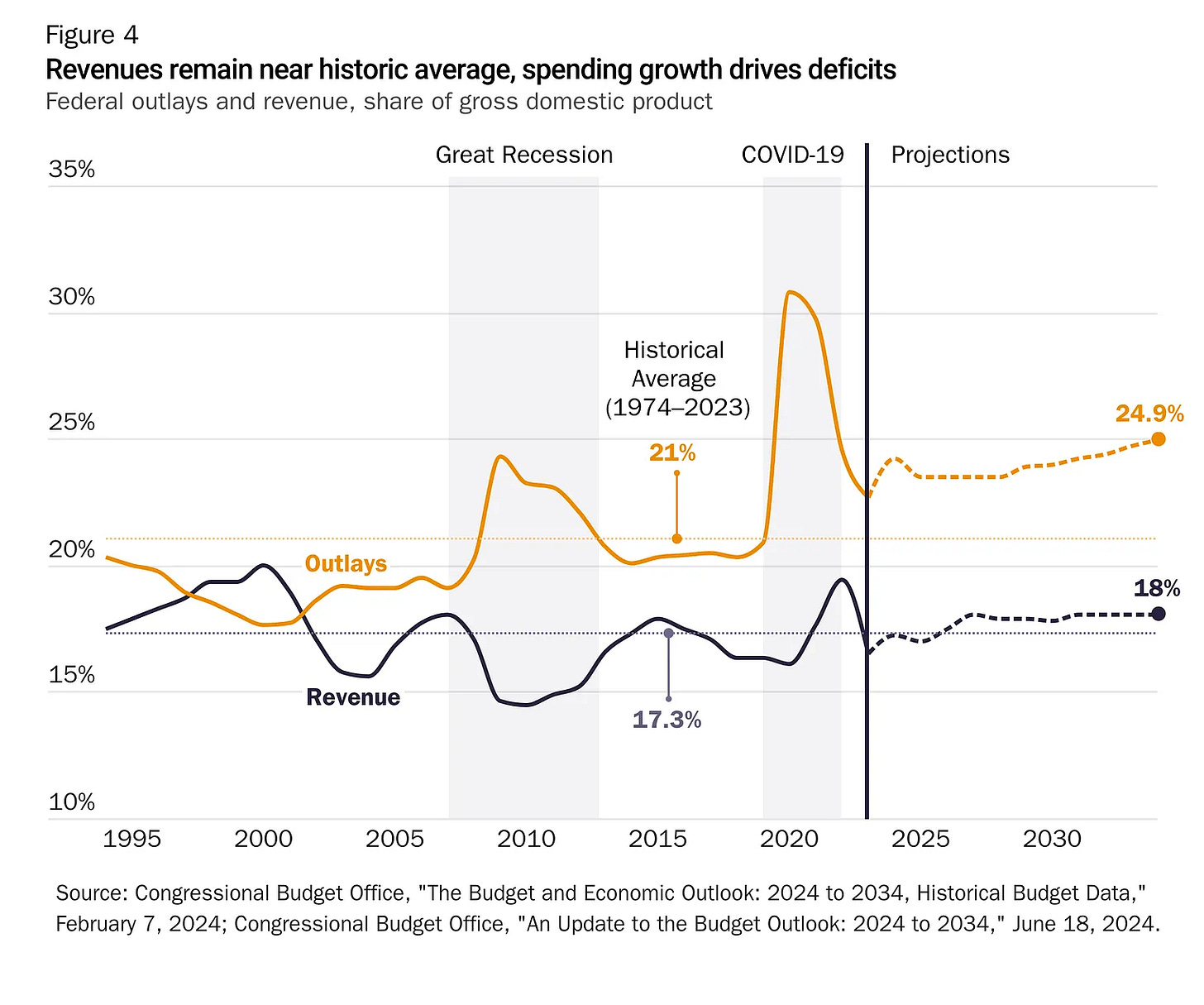

Raising revenue alone cannot fix out-of-control spending. Cato’s Adam Michel and Joshua Loucks have recently published a FAQ on the Tax Cuts and Jobs Act (TCJA), addressing several key questions surrounding the Act. Regarding the TCJA’s effects on deficits, Michel and Loucks write, “The Joint Committee on Taxation estimated the TJCA would add $1.5 trillion to the deficit over ten years. The Tax Foundation found that accounting for the dynamic effects of economic growth, the ten‐year deficit effect would be $448 billion, more than $1 trillion less than the official static estimate. [...] [T]he tax cuts were a one‐time addition to the debt and not an ongoing contributor to the deficit. […] Congress should prioritize keeping taxes from rising, but any tax cuts must be paired with spending cuts or other reforms to ensure low taxes remain permanent. Figure 4 shows that since 2000, Congress has allowed spending to grow faster than revenues and significantly faster than the economy. These trends are unsustainable, but raising revenue alone cannot fix out‐of‐control spending growth.” For more on how to cut taxes without raising deficits, read the new Cato Tax Plan.

Unsustainable debt could trigger a bond market crisis. In a blog addressing the growing federal debt problem, the O.C. Register highlighted our piece on the dangers of unsustainable debt: “As explained by Romina Boccia and Dominik Lett at the Cato Institute, ‘Excessive government debt drags down the economy by crowding out more productive investments that improve American living standards. Further, “as debt grows unabated, there is the risk of a sudden loss of confidence in bond markets, with investors demanding much higher interest rates that could trigger a debt doom loop and broader fiscal crisis.’” The blog correctly points to the primary drivers of the rising debt, noting: “Entitlement programs must be kept in check and no part of the federal budget should be immune from cuts.” For more on the negative fiscal impacts of unsustainable entitlement programs, see here.

Fiscal responsibility to avoid a vicious cycle. Bill Dudley, a former president of the Federal Reserve Bank of New York, reacts to the latest Congressional Budget Office (CBO) report: “The US is taking a big risk by running large and chronic fiscal deficits. The more it borrows, the greater the chance it’ll end up in a vicious cycle, in which government debt and interest rates drive one another inexorably upward,” writes Dudley. As Dominik Lett and I have written, to avoid entering this vicious cycle like Greece did in 2009, “Congress and the Biden administration should cut spending now while the economy is growing and conditions are favorable for deficit reduction, alleviating pressure on interest rates and the federal debt to grow, and before a fiscal crisis forces their hands.”

From vicious to virtuous cycle. James Carter, former Associate Director of the National Economic Council, explains: “Rising deficits grow the debt, and the growth in the debt aggravates the deficit, further increasing interest costs. It is a vicious, debilitating cycle. [...] To avoid fiscal disaster, policymakers must act to stabilize the federal debt-to-GDP ratio through a combination of spending restraint and policies to accelerate long-term economic growth. [...] Spending restraint combined with faster economic growth will lead to a needed reduction in the deficit, producing additional savings in the form of reduced interest payments. This will further shrink the deficit. A virtuous cycle!” Carter also correctly points out that the spending cuts should mostly target mandatory programs, which make up the largest portion of total government spending. However, cutting spending on mandatory programs such as Social Security and Medicare is a politically challenging task. A BRAC-like fiscal commission of independent experts could overcome those political obstacles, implement fiscally responsible spending cuts, and help usher the US into the virtuous cycle.