Here are this week’s reading links and fiscal facts:

ICYMI. Our recent blog, “The Threat of Fiscal Dominance: Will the US Resort to Money‐Printing to Finance the Rising Debt Challenge?” was featured on FoxBusiness! In this piece, Dominik Lett and I discuss how unsustainable spending and growing federal debt could lead the Fed to subordinate inflation control for supplying the Treasury with cash to finance unsustainable deficits. Read the blog here.

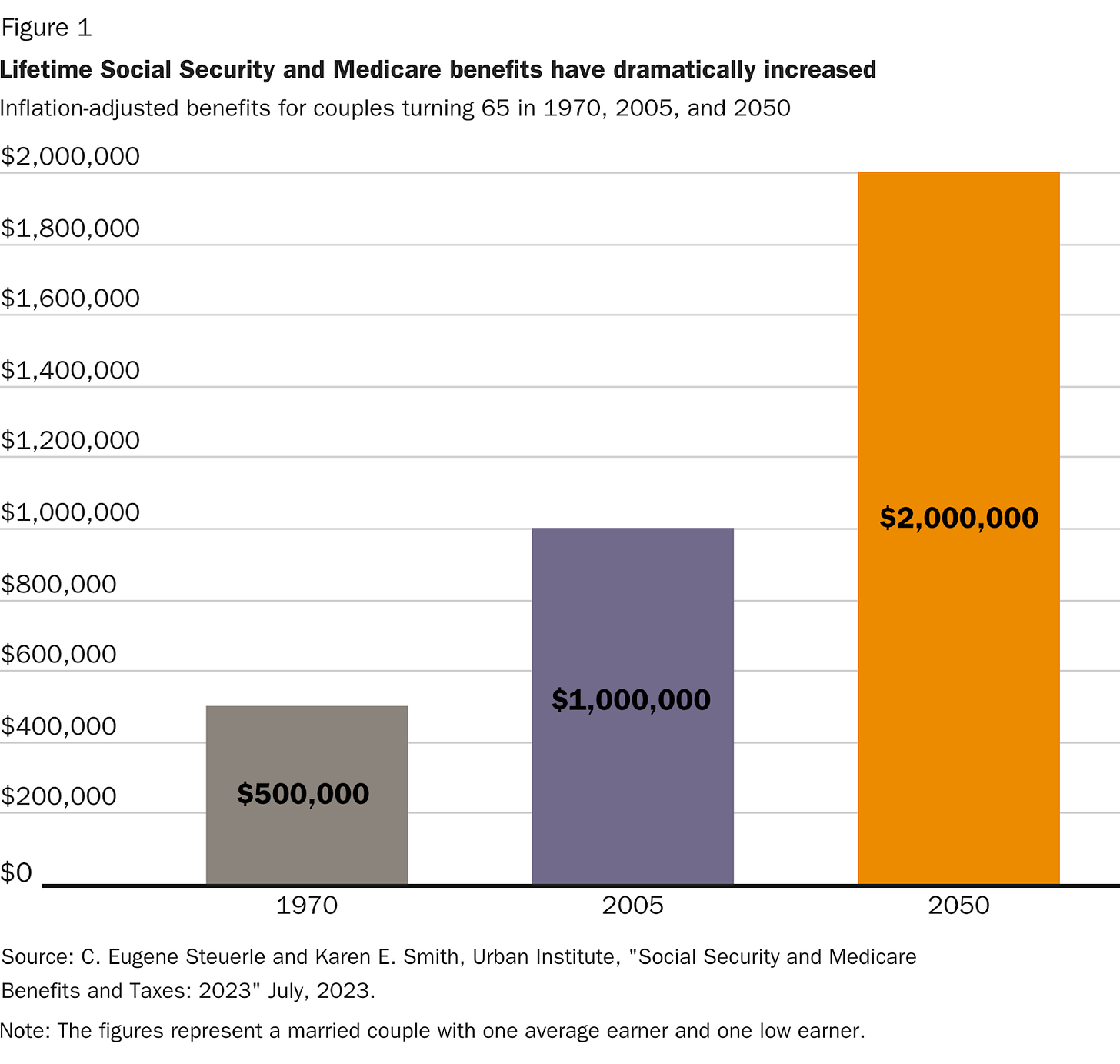

Medicare and Social Security spending is unsustainable. Eugene Steuerle, Richard B. Fisher Chair at the Urban Institute, notes that “[I]nflation-adjusted lifetime Social Security and Medicare benefits for a couple with average and low wages over their lives have grown from a bit over $500,000 for a couple turning 65 in 1970 to more than $1 million for a similar couple in 2005 and are scheduled to reach over $2 million in 2050 for a similar millennial couple aged 40 in 2025 [see the figure below].” This steep increase in the generosity of benefits is a significant driver of rising deficits and debt. Notably, Social Security and Medicare are responsible for 100 percent of US unfunded obligations over the next 75 years. Congress could solve most of the funding gap by freezing current benefits and only adjusting them for inflation. See this paper by John Cogan for further details.

Paul Ryan warns that a debt crisis is ahead. In an interview with Bloomberg, Former House Speaker Paul Ryan warned that “the next president has a reasonable chance of having a debt crisis on their watch.” He also emphasized that failing to address Social Security and Medicare increases the possibility of a debt crisis and harms current seniors who could soon face benefit cuts. The Congressional Budget Office (CBO) projects that the US debt will exceed its record high by 2028 at the end of the next presidential term. As Dominik Lett and I have written, “If policymakers continue to put serious fiscal reform on the back burner, the severity and scope of necessary reforms will grow. High and rising debt causes a significant drag on the economy and threatens America’s fiscal and economic future.”

Reduce deficits now to avoid fiscal crisis. On the Cato Daily Podcast with Caleb Brown, Cato’s Ryan Bourne discussed unsustainable federal budget deficits, the possibility of a fiscal crisis, and potential solutions. “In an ideal world, we would have a fiscal commission, like my colleague Romina Boccia has proposed, focused on spending-based deficit reduction that would incorporate major reform of entitlement programs,” said Bourne. He added that if politicians are unwilling to touch these unsustainable programs, the next best option would be to cut wasteful and economically harmful spending, such as farm subsidies. Bourne further suggested that if neither of these options is pursued, policymakers should develop a fiscal resolution plan (or “living will”) detailing the actions they would take in the event of a fiscal crisis. For more on this, read Ryan’s paper “A Case for Federal Deficit Reduction” here. For more about the fiscal commission, see here.

Address the unsustainable mandatory spending. In a recent op-ed for the Hill, Rep. Jodey Arrington (R-TX) criticized Congress for prioritizing discretionary spending debates over addressing the rapidly growing mandatory spending. “Why do we devote excessive attention to budget issues of diminishing relevance instead of matters of growing — and potentially existential — significance? [...] Politically, appropriations debates revolve around how much more to spend. Indeed, every discretionary program increases annually by inflation. So according to Washington’s Alice in Wonderland rules, even a spending “freeze” can be portrayed as a cut. In contrast, debates on reforms to mandatory spending default to how much to cut, creating political dissonance for lawmakers and special interests. As a result, many in Congress fear the political consequences of addressing — or even just discussing — mandatory spending,” writes Rep. Arrington. As I have previously noted, “While controlling discretionary spending is important for fiscal responsibility, [...] America’s biggest fiscal challenge lies in the unchecked growth of federal health care and old-age entitlement programs. Repeated shutdown fights and a slew of temporary continuing resolutions have gotten us no closer to reforming Social Security and Medicare.”