Debt Digest | OBBBA Accelerates Social Security Insolvency

Links & Fiscal Facts

Here are this week’s reading links and fiscal facts:

Stephen Miran as Fed Chair is bad news for US consumers and dollar reserve status. The Wall Street Journal editorial board raises concerns about President Trump’s nomination for Federal Reserve Chair. Miran is “an ardent promoter of the President’s economic policies, especially tariffs, ” and his “preoccupation is devaluing the dollar to reduce the flow of capital and imported goods to the U.S.” Cato’s Jai Kedia warns: “Encouraging a weaker US dollar is bad economic policy.” He explains that “if consumers see their real wealth reduced from an erosion of the value of their dollars, their demand for goods, including domestic products, will drop—hurting the very [US multinational corporations] that the ‘weak dollar’ policy is supposed to help.” Furthermore, a weaker US dollar threatens the US dollar’s status as the world’s reserve currency: “If foreign investors are concerned about losing money when exchanging their own currencies for the USD, their appetite for US financial products could fall, lowering US asset prices.” He concludes, “Expecting or encouraging a weaker dollar is not the way to make US goods more attractive any more than a dose of caffeine and sugar is a sustainable way of fueling a workday. Yes, it could work in the short run, but the long-run effects not only undo but also outweigh any quick gains.”

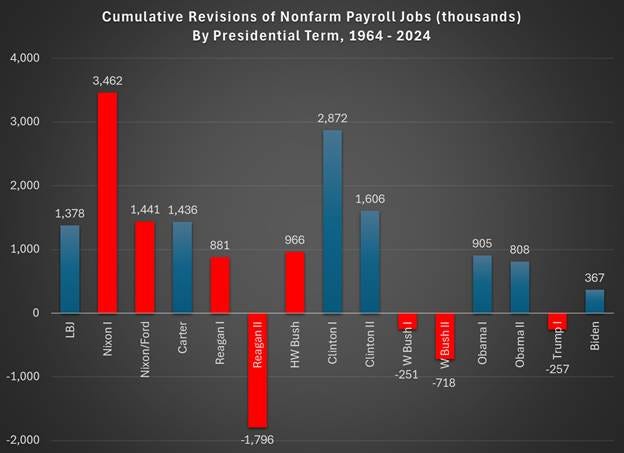

EJ Antoni is unfit for BLS Commissioner. Dominic Pino of the American Institute for Economic Research writes in National Review: “President Trump has nominated an unqualified economist to take over one of America’s most important statistical agencies. […Antoni] has demonstrated time and again that he does not understand economic statistics.” Pino gives many examples of Antoni’s inability to interpret and present data (here, here, here). As Pino points out, Trump “fired [former BLS Commissioner] McEntarfer because he believed the jobs reports were “rigged” against Republicans,” while “[s]ome tried to defend Trump’s move by saying he was demanding improvements to the agency’s methodology.” Cato’s Jeremy Horpedahl shows [see figure] that BLS revisions have been getting smaller, and “Democrats have later had upward revisions, and all Republicans have had subsequent downward revisions.” As Pino emphasizes, “[i]f it was really true that Trump wanted to modernize and improve the BLS, he would have nominated someone with deep experience in economic data collection who has published research on statistical methodology and has ideas about how to make the nuts and bolts of the BLS work better. His nomination of Antoni proves that he wants a lackey instead.”

CBO estimates debt service of OBBBA costs at $718 billion. In a new report, the CBO projects additional interest costs push the total deficit addition of the reconciliation bill over 10 years to $4.1 trillion. Furthermore, if Congress makes the tax provisions in the OBBBA permanent, the cumulative effect on the deficit rises to $5.0 trillion. In the report, they do not account for “[o]ther factors, such as administrative actions affecting tariffs and immigration, [that] have affected deficits and debt since January 2025.” They will score these effects in the next baseline. As Lett writes, expect “the bill’s $10-year cost [to] soar past $6 trillion. […] Congress is putting the nation on a fast-track to a debt spiral.”

OBBBA accelerates Social Security insolvency. Howard Gleckman of the Tax Policy Center comments: “The Social Security Administration projects the 2025 budget law Congress passed in July will accelerate insolvency of the program’s retirement trust from early 2033 to late 2032. […] It means the program will go insolvent during the term of the president who succeeds Donald Trump. That soon.” This date sets up a political deadline for reform, but Social Security already strains US finances. As Boccia and Nachkebia emphasize, “[w]ith Social Security running large and rising cash-flow deficits since 2010, and given a political desire to protect most current retirees from being affected by benefit reductions, Congress should act now to stabilize the system—not procrastinate any longer, which only ensures that inevitable changes will be more drastic and economically harmful. They detail potential reforms in their newly released book, Reimagining Social Security: Global Lessons for Retirement Policy Changes.

Trump Administration plans to rescind a Biden-era Supplemental Security Income (SSI) benefit increase. According to Arthur Delaney of the HuffPost, “The Trump administration has given notice that it plans to rescind a change finalized last year allowing more Supplemental Security Income beneficiaries to receive full benefits even if they live with someone who helps them with food or shelter.” The American Enterprise Institute’s Mark Warshawsky commented that the removal of food from the calculation of benefits should have been rejected in the first place. He cited several reasons, including “it is inconsistent with the requirements of the law,” and “the estimated transfer of $1.5 billion from taxpayers to beneficiaries, without legislation, violates the major questions doctrine of the Supreme Court”. The $1.5 billion price tag for taxpayers far outweighs the estimated $25 million in administrative savings. The Trump administration is right to reverse this Biden-era executive policy change.