Here are this week’s reading links and fiscal facts:

No plan to fix Social Security as benefit cuts loom. The Committee for a Responsible Federal Budget (CRFB) estimates that once the Social Security trust fund is depleted, annual benefits for a low-income, dual-income couple would decrease by about $10,000. Medium and high-income dual-income couples would see their benefits reduced by $16,500 and $21,800, respectively (see figure below). With just one day before the US presidential election, neither candidate has offered a comprehensive plan to fix Social Security’s funding problems. In fact, former President Donald Trump’s proposal to eliminate taxation of Social Security benefits would worsen the program’s finances. Cato’s Adam Michel has argued against this proposal, stating that “a larger share of Social Security benefits should be included in taxable income in favor of lower tax rates for everyone, not just seniors.” Instead of adopting reforms that widen the program’s finance gap, Congress should pursue reforms that reduce benefit costs. For more on such reforms, see our Social Security fact sheet.

Ignoring debt could lead to severe consequences. Economist Daniel Lacalle challenges claims that downplay the US debt problem, pointing to the inflationary effects of unsustainable debt: “[Inflation] is the most regressive form of taxation, primarily affecting the poorest.” He warns against ignoring the dangers of debt, stating: “Saying that nothing will happen if debt continues to rise and deficits continue to drive government policy is, literally, like saying that an alcoholic should drink more vodka because cirrhosis has not killed him yet.” As I’ve covered before, “The belief that debt doesn’t matter is a luxury belief that disregards the lived experiences of the poor and working class when inflation hit. [...] Congress and the executive should prioritize fiscal responsibility and economic policies that enable prosperity for all Americans, not just the privileged few.”

Deteriorating fiscal outlook threatens the dollar’s global dominance. According to Visual Capitalist, 59 percent of the world’s foreign currency reserves are held in US dollars, followed by euro (20 percent) and Japanese yen (6 percent). However, the dollar’s dominance has declined since 2000, when it comprised 70 percent of global reserves. With persistent deficits and mounting federal debt, the risk of fiscal dominance—where the Fed prints excess money to support government deficits with higher inflation—increases, which can jeopardize the dollar’s status as the “world’s reserve currency.” As Dominik Lett and I’ve previously written, “Fiscal dominance could also deteriorate the reputation of the US as a guarantor of its credit. The perception of Treasury securities as safe assets undergirds the entire financial system. US policymakers should not clumsily waltz into additional periods of fiscal dominance that could contribute to economic instability and reduce the global standing of the US dollar.”

A debt crisis could strike abruptly. Economist Arnold Kling highlights Argentine President Javier Milei’s success in slashing bureaucracy but notes that “The Milei chainsaw [cutting bureaucracy] won’t bring outlays in line with revenues [in the United States].” It is because mandatory spending on entitlement programs like Social Security and Medicare, not bloated bureaucracy, is the main driver of US fiscal troubles. Kling warns of the dangers of growing debt and describes how a debt crisis could unfold: “It is possible that the bond market will remain in the high-confidence state for many more years. [...] But at some point, there could be a sudden shift to the crisis state. Although such a debt crisis has been building up slowly and was anticipated for a long time, the actual event will take place rapidly, over the course of a few days.” As I’ve argued, a BRAC-like fiscal commission of independent experts offers the best chance to tackle unsustainable entitlement spending and prevent a fiscal crisis.

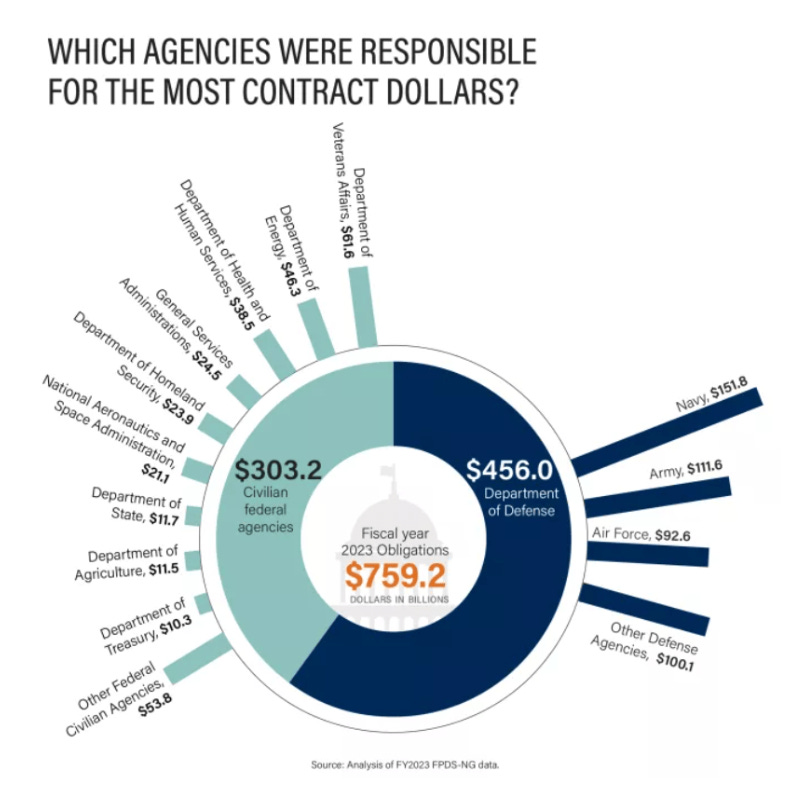

Cut wasteful spending on federal contracts. Cato’s Chris Edwards suggests reducing government spending by eliminating “the waste and overcharging in federal contracting [.]” According to Edwards, the federal government procures $750 billion of goods and services annually, with the Department of Defense (DOD) accounting for 60 percent of the total. He notes that federal contractors are known for cost overruns and inflated profits, highlighting the case of Raytheon, a major US defense contractor, which was fined $428 million by the Department of Justice (DOJ) for inflating costs in government contracts. Furthermore, Edwards cites a CBS News investigation that states that military contractors overcharge the Pentagon “on almost everything.” He concludes: “If true, procurement reform has a lot of potential. This Government Accountability Office chart suggests which agencies the new administration should target for savings [see the chart below].”