Here are this week’s reading links and fiscal facts:

Keeping Republicans fiscally conservative. Richard Hanania outlines the rise of the tech right, including the rising influence of Elon Musk, David Sacks, and Joe Lonsdale. “The Tech Right is in many ways anti-populist, and will hopefully stand in the way of those trying to make Republicans more friendly to labor unions, entitlement spending, and economic regulation…keeping the Republican Party dogmatically anti-tax is the only hope we have for not descending further into gerontocracy…Heading off economic populism now and not letting conservatives become too attached to protecting entitlements needs to be a top priority.”

Deficit totals $2.1 trillion over the past year. The federal budget deficit over the past 12 months was twice as large as the pre-pandemic deficit. “Rising spending on net interest, Medicare, Social Security, and student debt cancellation have more than offset declining spending on pandemic relief,” reports the Committee for a Responsible Federal Budget (CRFB).

Fitch Ratings contemplates federal credit downgrade. Fitch Ratings, one of three major credit agencies, warned that it might still downgrade the United States’ credit rating. “It’s not just the debt limit,” Fitch Ratings’ head of sovereign and supranational ratings said in an interview. “What we’ve seen in the United States is a steady deterioration in governance.” A BRAC‐like external fiscal commission could “build a firewall to shield policymakers from political risks inherent in supporting fiscal reforms that will inevitably result in winners and losers.” Boccia explains more here.

CBO alters debt projections. The Congressional Budget Office optimistically estimates that the Fiscal Responsibility Act saves $1.5 trillion over the next 10 years, reducing the projected federal debt held by the public in 2033 by about 3 percent, from 119 percent of GDP to 115 percent. Most of those savings are unlikely to be realized due to loose spending constraints and budget gimmicks. Even assuming CBO is right, an additional $7 trillion ($8.5 trillion total) in savings will be necessary to stabilize the debt. See Boccia’s suite of reforms here.

Understanding the new GOP tax bill. House Ways and Means Committee Republicans just introduced the American Families and Jobs Act. As Adam Michel explains, “Most of the Republicans’ major proposed changes…expire after 2025, worsening current tax uncertainty and obscuring the necessary reforms’ fiscal cost.” Instead of suggesting temporary changes that should be made permanent, Republicans could repeal other bad tax policies, like IRA tax credits, to pay for important tax improvements. Absent offsetting the lost revenue, CRFB estimates that making the American Families and Jobs Act reforms permanent would cost $1 trillion over 10 years.

CRS updates primer on disasters and emergencies. The Congressional Research Service explains the basics of national emergency response in this report. Federal disaster assistance is available through many channels, including FEMA, the Small Business Administration, the Department of Housing and Urban Development, the Army Corps of Engineers, and more. As Boccia and I write, “Congress has enormous latitude in determining what appropriations it designates as emergency funding.” To limit emergency spending growth, Congress should adopt notional emergency spending accounts to track and enforce offsetting spending reductions.

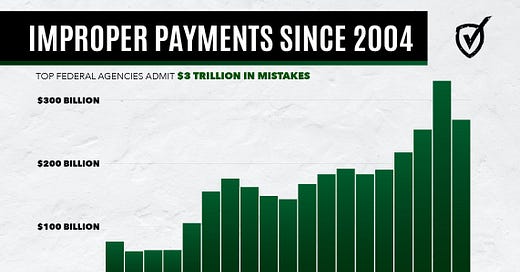

Improper payments skyrocket due to pandemic spending spree. Improper and mistaken federal payments totaled $247 billion in 2022. See the graph below for historical context. Adam Andrezejewski writes, “Federal bureaucrats must find ways to provide more adequate spending controls and stem this enormous tide of improper payments. Otherwise, government waste of this magnitude will only continue eroding the public trust.” The best solution to stem the growth in improper payments is to reduce government spending as Rachel Grezler argues here. The Government Accountability Office highlights the many fraud and accountability issues caused by the size, scope, and speed of COVID-19 relief spending here.