Here are this week’s reading links and fiscal facts:

Rescind unspent COVID funds. According to Rachel Greszler and Anthony Campau from the Economic Policy Innovation Center (EPIC), as of December 2023, $175 billion of the $350 billion from the Coronavirus State and Local Fiscal Recovery Fund (SLFRF) was allocated to ongoing projects, instead of addressing pandemic-specific needs. The distribution of these federal taxpayer dollars has been neither equal nor needs-based. “Rather, it’s been a slush fund for state and local governments to pay for ordinary expenses, boost their revenues (that were up 13% and 24% in the two years following the pandemic), give bonuses to government workers, and dole out cash to select organizations under a myriad of all-encompassing expenditure categories,” argue Greszler and Campau. To avoid further wasteful spending and reduce excessive federal deficits, Congress should claw the remaining SLFRF funds back. As Dominik Lett and I argue: “With the pandemic over, unspent COVID-19 funds should be rescinded to offset new spending [like the Ukraine-Israel-Taiwan foreign aid package].”

US fertility hits a new 44-year record low. The Associated Press reports: “A little under 3.6 million babies were born in 2023, [...] That’s about 76,000 fewer than the year before and the lowest one-year tally since 1979.” As Cato’s Vanessa Brown Calder and Chelsea Follett highlight, some Congressional members worry that “population decline could lead to negative economic, fiscal, and social outcomes, including a decline in overall gross domestic product, wider solvency gaps for major federal programs and public pensions, a rising dependency ratio, and a decline in social capital.” The 2023 Social Security Trustees report acknowledges the negative consequences of lower fertility rates, stating: “the OASDI cost rate will rise rapidly between 2023 and about 2040, primarily because the number of beneficiaries rises much more rapidly than the number of covered workers as the baby-boom generation continues to retire and is replaced at working ages by lower birth-rate generations.” As Follett and Calder argue: “Instead of replicating costly and unsuccessful international initiatives, policymakers should recognize that a genuinely pro‐family policy means less government, not more.”

End the abuse of emergency spending. Veronique de Rugy from the Mercatus Center criticizes the exploitation of emergency spending to circumvent the checks of the regular budget process. She explains, “Because these bills are often passed quickly and under the pretense of pressing needs, there is less scrutiny of the spending compared to what occurs during the regular budget process. It's an opportunity for wasteful spending and the allocation of funds to projects that are not so urgent.” On Friday, May 3rd, I’ll be joined by de Rugy, Kurt Couchman (Americans for Prosperity), and David Ditch (The Heritage Foundation) to discuss how the abuse of emergency spending negatively affects the US fiscal health. For more details, see here.

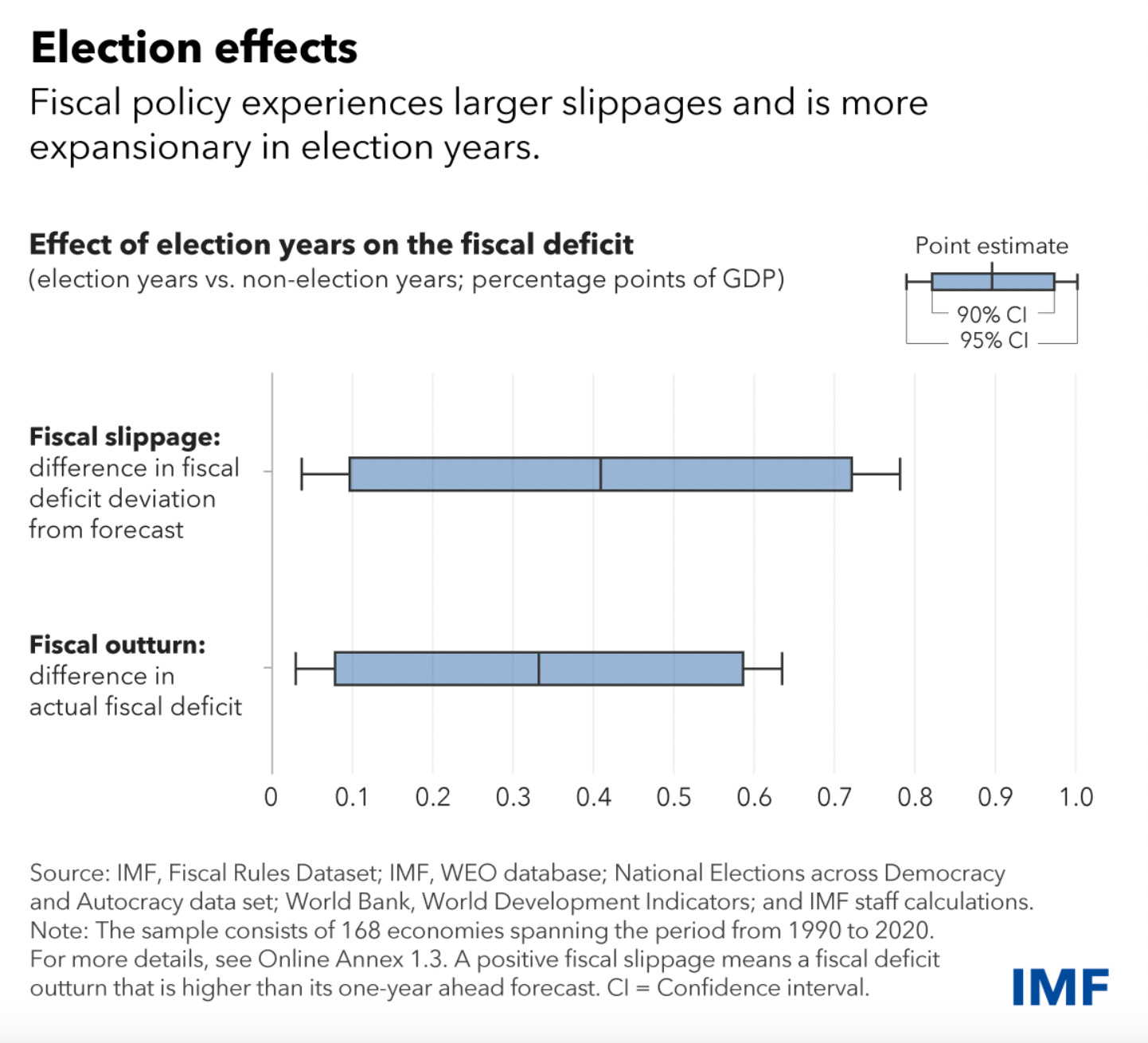

The IMF recommends exercising fiscal restraint, especially this election year. According to a recent International Monetary Fund (IMF) study, “History shows governments tend to spend more and tax less during election years. Deficits in election years tend to exceed forecasts by 0.4 percentage points of GDP, compared to non-election years [see figure below].” With growing public debts in many countries, including the US, the IMF’s advice is clear: “Governments should immediately phase out legacies of crisis-era fiscal policy, including energy subsidies, and pursue reforms to curb rising spending while protecting the most vulnerable. Advanced economies with aging populations should contain spending pressures for health and pensions through entitlement reforms and other measures.” Congress should heed the IMF’s recommendation to cut spending and address unsustainable entitlement spending. An independent BRAC-like fiscal commission could help.

A novel approach to means-tested welfare programs. Michael Magoon, the author of the "From Poverty to Progress" book series, proposes replacing means-tested welfare programs like Medicaid and SNAP (i.e., food stamps) with Upward Bound accounts. These accounts would be associated with a debit card restricted to purchases that are proven to contribute to long-term increases in income or wealth, such as tuition for education and job training programs. “Upward Bound merely gives youths cash that they can spend how they like, as long as it is proven to promote long-term upward mobility. Combining this with a four-year phase-out of our current means-tested programs will radically change the incentives for poor and working-class persons [...] While the purpose of this reform proposal is to promote Upward Mobility, it also has the benefit of saving hundreds of billions of federal tax dollars every year. If the proposal results in increased labor participation, then the savings will be even more,” argues Magoon.