Here are this week’s reading links and fiscal facts:

A US sovereign wealth fund would reduce returns on private pension assets. Mark J. Warshawsky, a senior fellow at the American Enterprise Institute (AEI), explains: “As I have explained in my critique of Senator’s Cassidy’s similar Social Security reform proposal, the economics are that the creation of a public fund is a tax on other pension assets, due to the reduction of their expected investment return. Moreover, the potential for misallocation of assets, especially to meet short-term political goals of the Presidential Administration then in office, is large. This latter concern, expressed by former Federal Reserve Chairman Alan Greenspan, shot down a 1990s proposal to invest TF [Social Security trust funds] assets in domestic equity securities.” In my recent op-ed for The Hill, I highlight other concerns around a US SWF, including the lack of surplus funds to invest, the risks of significant state ownership of private companies, and the fact that a SWF wouldn’t generate new wealth but simply redirect capital from the private sector to the government.

Foreign anti-bribery law is misguided. President Trump has ordered the DOJ to pause enforcement of the Foreign Corrupt Practices Act (FCPA), which bans American companies from bribing foreign officials. Cato’s Walter Olson argues that the FCPA is “a feel-good exercise in overcriminalization that tempts revenue-hungry American regulators to insult coequally sovereign governments by meddling in overseas wrongdoing [...] in which Americans had been neither wrongdoers nor victims.” He also notes that the law “inflicts penalties on unwitting higher-ups and investor bystanders based on the actions of rogue locals.” Olson concludes: “Making us feel better isn’t a good enough reason for a law.”

House Budget Committee boosts spending cuts in resolution. On Thursday, the House Budget Committee advanced an amended budget resolution, strengthening spending cut targets. As EPIC’s Matt Dickerson explains, the committee adopted an amendment from Rep. Smucker (R-PA) that ties the size of the tax cut to spending cuts, including by increasing the minimum savings target from $1.5 trillion to $2 trillion. This change ensures any shortfall in spending cuts reduces tax cuts accordingly, while exceeding the target allows for larger cuts. While this move lessens the deficit impact of extending the 2017 tax cuts, the resolution's targets are still a far cry from stabilizing the US debt. Additional credit to Reps. Jodey Arrington (R-TX), Chip Roy (R-TX), and Ralph Norman (R-SC) for pushing a more responsible approach—let’s hope House Republicans follow through with deeper, lasting reforms. See our initial reactions to the House and Senate budget resolutions here and here.

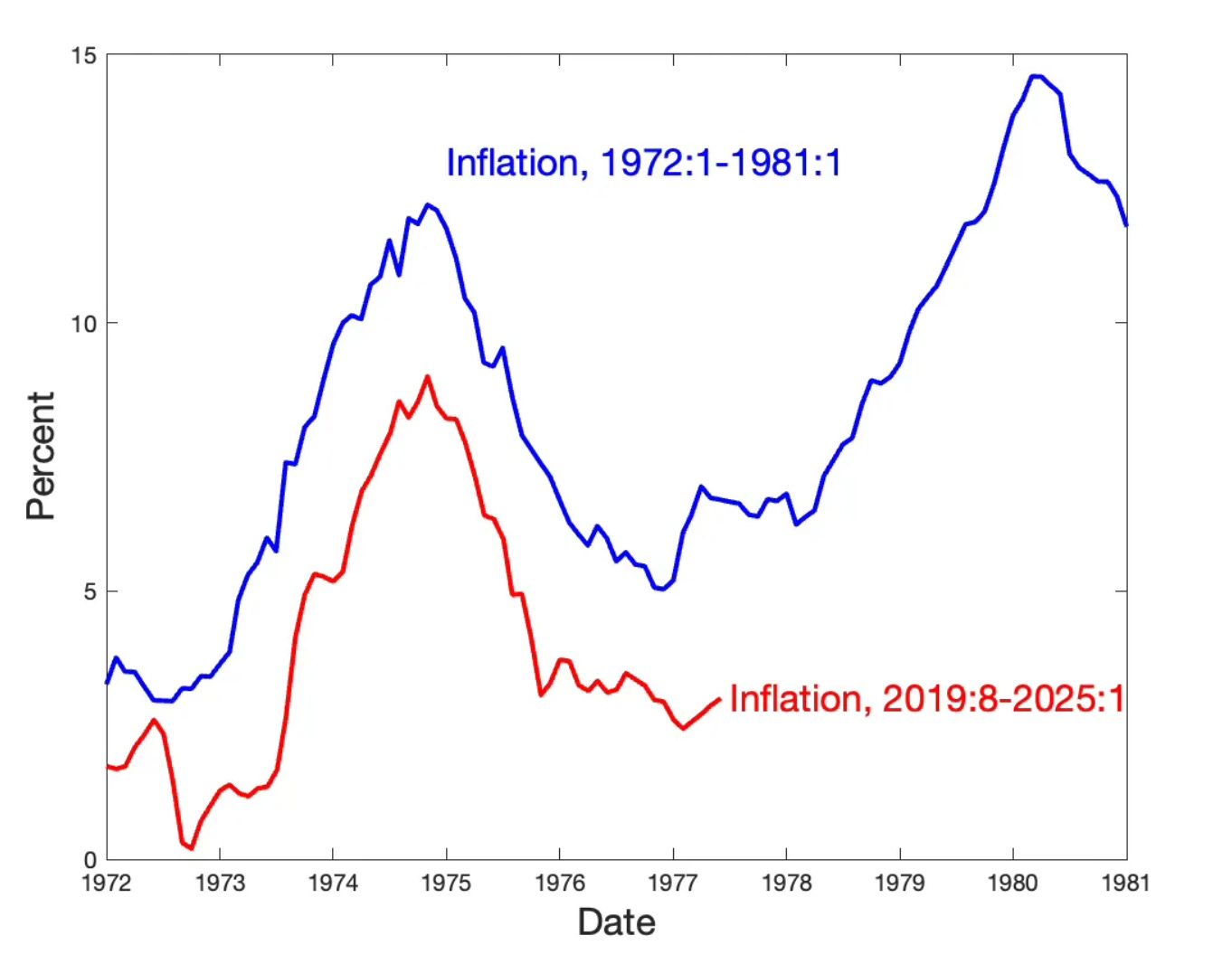

Excessive borrowing could reproduce ‘70s inflation. As the Hoover Institution’s John Cochrane writes, there are some eerie similarities between the 1970s inflationary episode and the most recent pandemic inflation episode (see the graph below charting annual percent change in prices). In the most recent inflationary episode, “the Fed kept interest rates still for an unprecedented full year while inflation surged […] the result is described as classic ‘war finance,’ how to deliberately stoke inflation by a fiscal blowout and low interest rates in order to inflate away government debt.” As we argue in our latest paper, “the rising US fiscal imbalance could lead to a repeat of the conditions of the 1970s. Faced with the politically daunting task of reforming entitlements or raising taxes, policymakers may continue to kick the can down the road, running up the national debt. This could eventually trigger a fiscal dominance regime of higher inflation, where strained government finances put pressure on the Federal Reserve to override its inflation control objectives.” With both CBO and Penn Wharton projecting that rising debt will accelerate Social Security’s funding shortfall, the need for reform is urgent—lest history repeat itself.

California’s megafire crisis is a policy failure, not just a natural disaster. The recent wildfires in Los Angeles, which killed at least 29 people and may cost up to $275 billion in damages, are an indictment of state and federal policies to mitigate fire risks effectively. In a recent Statecraft interview, Santi Ruiz and Matt Weiner discuss some of the challenges to fire mitigation, such as prescribed burns and mechanical thinning. One key idea: while climate change has indeed made conditions hotter and drier, policy choices—such as restrictive environmental reviews and insurance regulations that distort risk pricing—have fueled the severity of fires. As we argued last month, federal disaster relief should not serve as a blank check for mismanagement. Instead, Congress should consider responsibly conditioning aid on meaningful reforms, including aligning insurance premiums with actuarial risk and reducing legal barriers to responsible land management. Without policy changes, taxpayers will continue footing the bill for predictable, preventable, and increasingly catastrophic wildfires.

Thanks to our intern, Anthony DeRegis, for his help in crafting this edition of Debt Digest.