Here are this week’s reading links and fiscal facts:

Taxing alone won’t fix our fiscal crisis. In a new paper, Manhattan Institute’s Brian Riedl argues that “Taxing the rich cannot even cover baseline deficits, much less finance the progressive spending agenda…revenue-seeking policymakers must prioritize economic growth, which is the real free lunch. A 1-percentage-point increase in the annual economic growth rate would save Washington $3.3 trillion over the decade.” Read the Peterson Foundation’s summary of Riedl’s paper here.

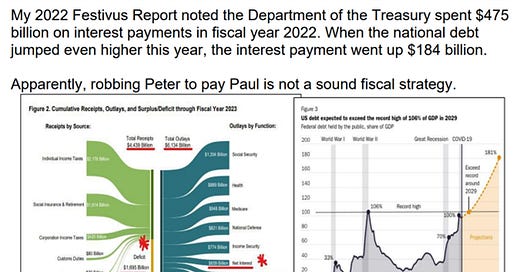

Festivus report outlines $900 billion in waste. Highlights include the military ruining $169 million in equipment due to improper storage outside, fraudsters using Barbies for proof of ID on COVID Paycheck Protection Program funds, and the government spending $6 million to boost Egyptian tourism. Senator Paul’s (R-KY) Christmas report also features one of our charts (see below)! Read the full report here.

America’s broken healthcare system. Bloomberg’s John Tozzi, Jennah Haque, and Madeline Campbell write, “Across the country, more than 350 hospitals had significantly lower-cost competitors even within just 5 miles — a reflection of how keeping prices behind a curtain has allowed big disparities to emerge. […] More than half the time, the less expensive facilities had quality ratings that were similar or superior to their pricier neighbors.” An overly concentrated health care market drives prices up and brings quality down argues Cato’s Michael Cannon. “Eliminating harmful regulation and letting consumers control the $4 trillion that fuel the U.S. health sector would restore the normal market mechanisms of entry, competition, and price-consciousness that combat inefficient consolidation.”

Honest military budgeting should account for veterans’ benefits. Like Social Security and Medicare, veterans’ benefits are promised now, but they are not financed until they come due, usually decades later. As Cato’s Michael Cannon explains, “In the case of veterans’ benefits, ‘promise now, pay later’ also hides the largest fiscal cost of the decision to go to war. As a result, it allows and encourages the president and Congress to risk U.S. lives when public opposition would otherwise prevent it. […] Annual disability payments to 1.7 million Vietnam-era recipients reached $30 billion in 2022 yet still haven’t peaked […] Congress didn’t stop paying Civil War-era benefits until 2020.” Cannon suggests pre-funding veterans’ benefits to “make existing burdens transparent, and make politicians account for them.”

More Americans subject to taxes on Social Security benefits. Brian J. O’Connor writes, “Over the past 39 years, both Social Security payments and federal income tax brackets have continually shifted upward to compensate for inflation — but the income thresholds that result in a retiree’s benefits being taxed have not.” In 1984, the tax was estimated to affect about 10 percent of Social Security recipients. By 2022, 48 percent of recipients were paying taxes on some of their benefits. The related but separate issue of raising Social Security taxes on earnings can face a similar problem as explained here. Under the Social Security 2100 Act proposed last fall, “Eventually, all covered earnings would be subject to payroll taxes, as the current-law taxable maximum rises with [the average wage index] to exceed $400,000. Social Security projects that this will occur in 2050.”

Even Krugman agrees deficits need to come down. The New York Times’s Paul Krugman writes, “Serious deficit reduction, a bad idea a decade ago, is a good idea now. […] But ask voters about specific spending, and there’s almost nothing they want to cut (see the AP-NORC graphic below). […] the economics of deficit reduction are straightforward. It can be accomplished either by reducing social benefits or by raising taxes.” To tackle the deficit problem, Congress should start with reforming politically popular and economically unsustainable entitlement programs. A fail-safe commission, as explained here, would be the best approach.