Here are this week’s reading links and fiscal facts:

Government intervention leads to higher health care prices. Cato’s Michael Cannon challenges the common misconception that the US health care market is largely unregulated. He argues that statements from pharmaceutical companies praising the government’s commitment to “a free‐market approach based on market‐driven prices,” are simply attempts “to protect the government interventions that let them charge higher prices than would prevail in a free market.” Cannon explains: “[C]ontrary to industry propaganda that holds government price controls only result in inefficiently low prices—US medical prices are often high because government controls them.” He delves deeper into the government's role in health care in a chapter he wrote for a recent book by Cato’s Ryan Bourne, titled "The War on Prices."

Reform the budget process. In a conversation with Santi Ruiz from the Institute for Progress (IFP), Dr. Douglas Holtz-Eakin, former Director of the Congressional Budget Office (CBO) and current President of the American Action Forum (AAF), stated: “I think Congress should pass a budget process reform bill, and I don't care what's in it. It could modify the Budget Act so that we have a debt-to-GDP target or something as small as that [...] But in the process of deliberating on that bill and then turning it into law, they would now own the budget process. It would be theirs. This Congress. So it's not the dead hand of some guy from 1974 telling me to do something. They don't care. But if they agreed, then at least for a couple of years, they're going to feel obligated to do that, and we'd have a process that functions.” Modifying the current budget process could promote accountability in Congress and help reduce unsustainable spending. For detailed reforms that can achieve these goals, see my briefing paper “How a Better Budget Control Act Would Limit Spending and Control Debt.”

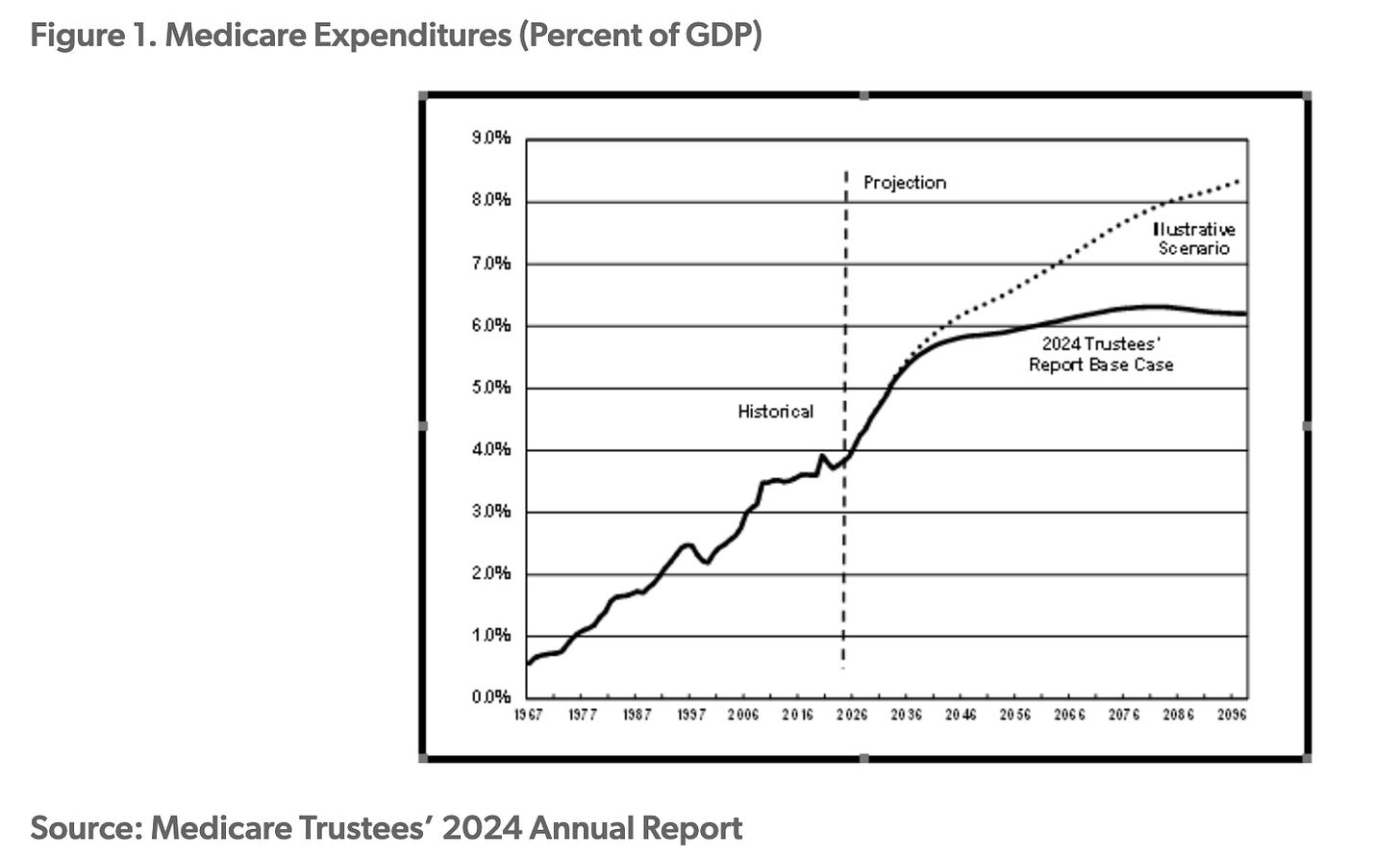

Medicare’s financial outlook worsens with realistic assumptions. According to the Office of the Actuary (OACT), “an evaluation of the financial status of Medicare that is based on the provisions of current law is likely to portray an overly optimistic outcome.” As the American Enterprise Institute’s (AEI) James C. Capretta explains, Medicare provider payment updates, as defined in the current law, are lower than the inflation rate, with “about 73 percent of hospitals already los[ing] money when caring for Medicare patients[...].” The 2024 Medicare trustees report provides an illustrative scenario where the payment update formulas are relaxed (i.e., the updates are larger) over the projection period. “With the alternative assumptions, total Medicare spending would be eight percent higher in 2050 compared to the base case assumption in the 2024 report, and more than 30 percent higher by the end of the projection period [see Figure 1],” writes Capretta. Medicare’s $53.1 trillion 75-year unfunded obligation, nearly 70 percent of the total unfunded obligation of the US government, is highly unsustainable. If the alternative scenario changes are implemented, which the OACT thinks is likely, Medicare’s substantial burden will grow further.

The Hoarding Rule will lead to more wasteful spending. The Wall Street Journal (WSJ) criticizes a Treasury rule that allows states to use remaining pandemic-related funds (the “Hoarding Rule”). “The change bends the law’s purpose, because by now it’s even less possible to justify new spending as a pandemic response. The economist Paul Winfree has tracked the money that’s already been misspent. ‘More than $185 million has been approved for projects related to golf courses,’ he writes in a new report for the Economic Policy Innovation Center, along with millions more for diversity coordinators and a literal circus. Extending the deadline will keep the party going,” writes the WSJ. Dominik Lett and I have previously written that Congress should rescind unobligated COVID-19 funds to offset deficit-spending bills (e.g., the Ukraine-Israel-Taiwan foreign aid package). As the WSJ concludes: “The federal government reached a new low in needless spending during the pandemic, and taxpayers will never get back trillions of dollars. Yet lawmakers can at least try to prevent the still unspent funds from again bailing out reckless states.”

Congress should stop evading spending limits and start budgeting responsibly. Politico reports that House Appropriations Chair Tom Cole (R-OK) has previewed interim subcommittee allocations, a.k.a. 302(b)s. Base funding levels for FY2025 are $895.2 billion for defense and $710.7 billion for nondefense, aligning with the base funding caps in the 2023 Fiscal Responsibility Act. Notably, Cole committed to “no side deals” this time around. In the previous two years, Congress has used various budget gimmicks and phony emergency spending to evade spending caps. Rejecting these gimmicks and budgeting more honestly could save tens of billions of dollars, but the House will face an uphill battle with a Senate that’s been eager to spend. Given the cumulative fiscal impact of repeated emergency spending abuse, that's a battle worth fighting.