Here are this week’s reading links and fiscal facts.

Reform Medicaid subsidies. As Cato’s Chris Edwards and Krit Chanwong explain, “Federal Medicaid costs have more than doubled over the past decade from $265 billion in 2013 to $616 billion in 2023. The federal government funds Medicaid with open‐ended matching payments to the states… Federal subsidies for the states create many distortions, which high federal matching rates exacerbate. A modest first step to reform Medicaid would be to reduce the ACA matching rate…The Congressional Budget Office estimates that such a reform would reduce federal deficits by $604 billion over 10 years.”

Fiscal commissions. National Review’s Jay Nordlinger writes, “Back in 2010, the Simpson-Bowles commission made its recommendations on budget policy. Everyone was against them — Democrats, Republicans, everybody. Dead in the water. A few years ago, [former White House budget director] Mitch Daniels was my guest on Q&A (here). I asked whether the country would be better off if we had adopted Simpson-Bowles. No doubt, said Daniels. And we need to do something like it, regardless.” Boccia explains how to increase the chances of a fiscal commission succeeding here.

Tax credit overpayments. Scott Hodge of the Tax Foundation explains, “In 2022, 27 percent of refundable tax credits were overpayments. In 2022, the IRS paid out $98 billion in refundable tax credits to four programs: the Earned Income Tax Credit (EITC), Additional Child Tax Credit (ACTC), American Opportunity Tax Credit (AOTC), and the Net Premium Tax Credit (Net PTC). Recent reports by the Government Accountability Office (GAO) and the IRS’s Inspector General for Tax Administration (TIGTA) estimate that $26 billion in refundable tax credits were overpayments.”

The folly of tax code subsidies. During the pandemic, Congress created a refundable payroll tax credit—the Employee Retention Tax Credit—intended to reward companies for keeping employees during the COVID-19 pandemic. “Since passage, the fiscal cost of the credit has ballooned to more than $230 billion, three times the original estimate,” writes Cato’s Adam Michel. “If we generously assume that all of the JCT’s initially estimated $77 billion went to keep employees on the payroll during the pandemic, we can conclude that the remaining $153 billion of ERTC spending was likely a windfall to business owners and third‐party processors who saw an opportunity to exploit the program’s complexity and lenient rules…Congress should expect similar types of grift, fraud, ballooning costs, and other unintended consequences [with new tax credit schemes]. The core lesson policymakers should learn from the mistakes of the ERTC is that the tax code and the IRS are not well‐equipped to distribute targeted subsidies.”

Global debt crisis brews. “‘Deficit and debt levels make us uncomfortable,’ said Daniel Ivascyn, chief investment officer at bond giant PIMCO, which is a little bit reluctant to own a longer-term bond. Spending plans lacking credibility were seen as most likely to spark market turmoil. Longer term, ‘government debt trajectories pose the biggest threat to macroeconomic and financial stability’, said Claudio Borio, head of the Bank for International Settlements monetary and economic department,” report Yoruk Bahceli, Dhara Ranasinghe and Maria Martinez for Reuters.

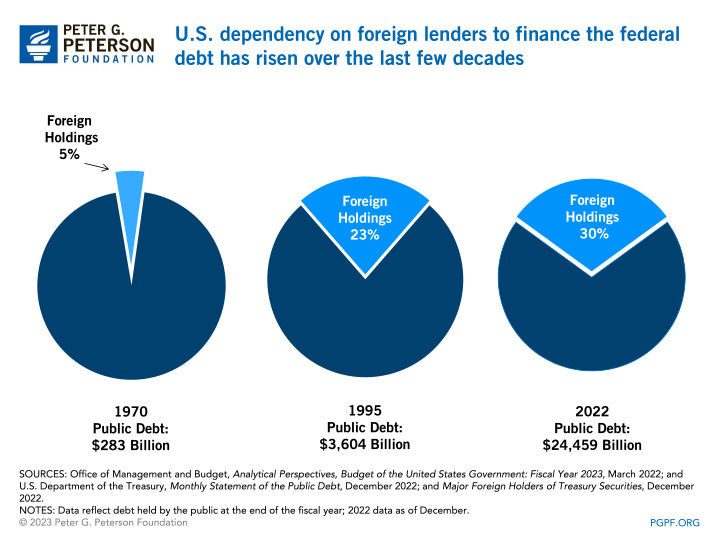

Foreign holdings and debt risk. The U.S. has grown increasingly dependent on foreign lenders to finance federal borrowing. See the Peterson Foundation’s graphic displaying foreign and domestic holdings of federal debt over time. “Nearly one-fifth of countries that defaulted or required debt restructuring had external debt (held by foreigners) of less than 40 percent of GNP, and more than half of countries experiencing debt crises had debt levels below 60 percent of GNP. Thus, 60 percent might be viewed as a rough barometer of high risk for budget failure,” explain Leonard E. Burman, Jeffrey Rohaly, Joseph Rosenberg, and Katherine C. Lim in a National Tax Journal study. Boccia outlines the potentially catastrophic longer-term scenario if spending and debt continue growing unabated here.