Here are this week’s reading links and fiscal facts:

Federal insurance expands. The Congressional Budget Office found that federal credit and insurance programs covered $37.3 trillion in 2021. That’s 160% of GDP or 1/3 of total financial assets owned by U.S. households and nonprofits. Federal insurance for banks and credit unions covered $19.4 trillion in the same year. Cato’s Norbert Michel argues that Congress should reduce federal deposit insurance coverage. “The argument behind expanding deposit insurance is that it reduces panics or bank runs. That may well be true in the short run, yet it comes at the cost of a tremendous reduction in market discipline. A World Bank study across more than 150 countries found that…countries with more‐generous deposit insurance schemes suffered more frequent banking crises.”

Reject debt limit budget gimmicks. Can the Treasury selectively default on the Fed’s debt? Paul H. Kupiec and Alex J. Pollock explain, “Fed operating losses are excluded from any federal budget deficit cap and its borrowings circumvent the statutory federal debt ceiling.” Kupiec and Pollock don’t recommend it but say nothing legally prevents such an extreme measure. Rather than misguidedly focusing on budgetary gimmicks to evade the debt limit, Congress should adopt policies to stabilize the debt as Boccia explains here. Norbert Michel explains how the Fed has become a piggy bank for excessive federal spending here.

Bipartisanship is necessary for entitlement reform. Polling by Rasmussen Reports finds that 46% of likely voters trust Democrats more to handle Social Security, while 44% trust Republicans more. “More voters now trust Democrats to handle Social Security, even as a majority agree President Joe Biden is “lying shamelessly” about the issue.” Medicare’s Hospital Insurance and Social Security’s Old Age and Survivors Insurance trust funds are projected to be exhausted by 2031 and 2033, respectively. Boccia argues that an independent commission can break legislative gridlock to enact necessary entitlement reforms.

Holding veterans funding hostage to spending increases. Aidan Quigley writes, “Democrats are pushing for veterans health care to become a separate category under the discretionary budget.” House Appropriations ranking member Rosa DeLauro [D-CT] said Democratic votes will be needed to pass any appropriations bill in the House. “This is the equivalent of shifting a monthly bill to a secondary checking account, and then claiming the change means you can afford to go on a shopping spree,” argue David Ditch and Frederico Bartels of the Heritage Foundation.

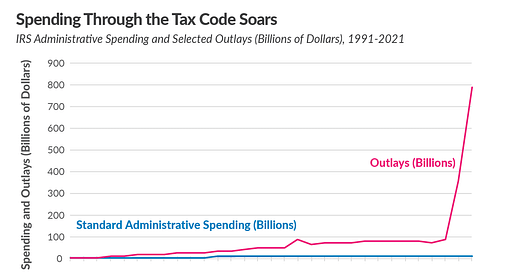

Simplify taxes. “If lawmakers learn any tax policy lesson from the past three years, let it be that simplifying the tax code is paramount,” write the Tax Foundation’s Erica York and Garrett Watson. See the graph below on the costs of spending programs through the tax code. Cato’s Adam Michel highlights four ways to simplify taxes here.