Here are this week’s reading links and fiscal facts:

Fix Medicaid financing. The Committee for a Responsible Federal Budget explains, “Medicaid is currently the largest health care program in the United States, covering 93 million lower-income adults and children and accounting for one in every six dollars spent in the health care system.” Medicaid’s joint federal-state financing scheme “encourages fraud, creates perverse incentives for state officials, and encourages states to enroll people who don’t need assistance,” argues Cato’s Michael Cannon. Gradually devolving control of Medicaid to the states could produce significant federal budgetary savings while encouraging cost-effective reforms.

Automatic cost-of-living adjustments overstate inflation. “Benefits from Social Security, Supplemental Security Income, federal civilian and military pensions, and dozens of other programs have received automatic cost‐of‐living adjustments (COLAs) to compensate for inflation annually since 1975,” writes Cato’s John Early. The consumer price indexes (CPI) used to calculate these COLA increases “systematically overstate inflation by approximately 1 percent per year” and have resulted in $5.6 trillion in excess benefits since 1975. Boccia and Early recommend using more modern, accurate CPIs, such as the chained Consumer Price Index (C-CPI), to generate upwards of $200 billion annually in savings.

Rural broadband subsidies benefit few and cost lots. On Monday, Biden announced how the Department of Commerce will be distributing $42.5 billion in internet subsidies over the next two years. As Randal O’Toole explains, the vast majority of rural Americans who benefit from the $8,800 per household already have access to broadband and are just as wealthy as urbanites. Rather than fund costly subsidies, it would be more effective to eliminate protectionist restrictions that delay and hamper market-based broadband expansion.

Ford EV loan is more harmful than helpful. NYT reports that Ford Motor and its battery manufacturing partner will receive a $9.2 billion loan to build three battery factories in Kentucky and Tennessee; the single biggest financial commitment the Biden administration has made for EVs thus far. As Cato’s Chris Edwards writes, “Biden’s corporate subsidy plans for EVs [electric vehicles] and other industries…crowd out private activities, undermine competitiveness, and supercharge the corporate lobbying frenzy in Washington.”

One quarter of 2022 refundable tax credits were overpayments. As the Tax Foundation reports, “the IRS paid out $98 billion in refundable tax credits to four programs: the Earned Income Tax Credit (EITC), Additional Child Tax Credit (ACTC), American Opportunity Tax Credit (AOTC), and the Net Premium Tax Credit (Net PTC).” Recent reports estimate that $26 billion in refundable tax credits were overpayments. “[L]awmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code,” argues Scott Hodge.

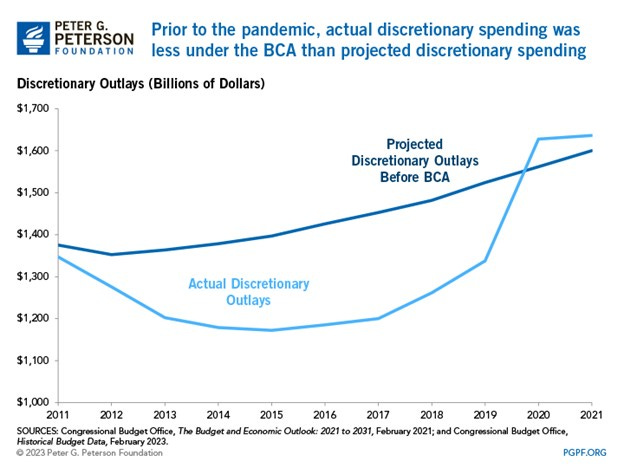

Do discretionary spending caps work? As the Peterson Foundation explains, “Discretionary caps are only as effective at reining in spending as lawmakers are committed to enforcing them.” Prior to the pandemic, the Budget Control Act’s (BCA) spending caps successfully reduced actual discretionary spending (see the graph below). Boccia explains how to improve on the BCA’s spending limits here.