Here are this week’s reading links and fiscal facts:

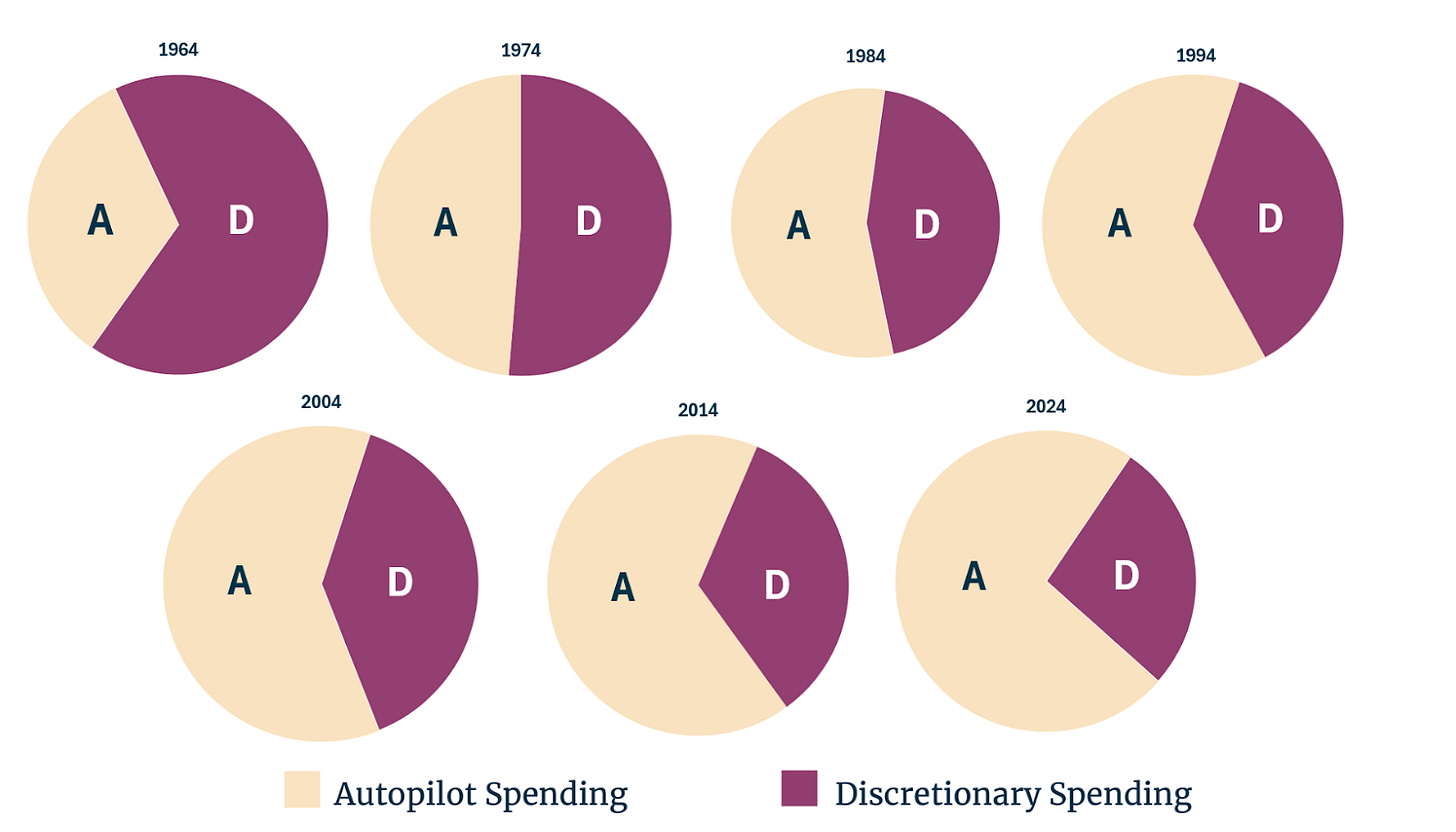

Growing autopilot spending is to blame for persistent deficits and growing debt. The Economic Policy Innovation Center’s (EPIC) Amelia Kuntzman illustrates the rising dominance of autopilot spending (mandatory programs and net interest) in annual federal spending (see figure below). The Congressional Budget Office (CBO) projects the share of autopilot spending will grow from 72 percent in 2023 to 82 percent in 2054. Entitlement programs like Social Security and Medicare are the key drivers of this trend and the broader US fiscal troubles. As I’ve written before: “Left on autopilot, the projected growth in these old-age benefit programs threatens to burden younger generations with insurmountable debt, economy-crushing tax hikes, and the black-swan threat of an unprecedented US fiscal crisis.”

Congress should offset TCJA extensions. According to the Committee for a Responsible Federal Budget (CRFB), some members of Congress are pushing to use the “current policy baseline” to extend the expiring provisions of the Tax Cuts and Jobs Act (TCJA). This approach would treat the temporary provisions as permanent, concealing the $3.9 trillion increase in deficits. As CRFB notes: “Not recognizing those costs of TCJA extension is a gimmicky attempt to ‘disappear them,’ but trying to hide them doesn’t make them any less real or damaging to the fiscal situation.” Rather than relying on budgetary gimmicks to hide the costs, lawmakers should pair any TCJA extensions with offsets. My colleagues at Cato, Adam Michel and Chris Edwards, have proposed 14 spending cuts, including eliminating junk food subsidies and ending student loan forgiveness. Additionally, Michel proposes repealing 12 tax expenditures, such as the Inflation Reduction Act (IRA) tax credits, to further support making the TCJA provisions permanent.

More options for spending cuts. Mercatus Center’s Veronique de Rugy offers a series of spending cut suggestions for the new administration. These include eliminating farm subsidies, reclaiming unspent funds from the Coronavirus State and Local Fiscal Recovery Fund, and ending all broadband subsidies. De Rugy also proposes terminating the Corporation for Public Broadcasting, shutting down the Export-Import Bank, and privatizing the Federal Aviation Administration and Amtrak. She also notes: “We should also remember that we can cut many programs from the budget, but failing to reform Social Security and Medicare means we are still on a fiscally unsustainable path.” As we’ve previously covered: “America’s economic future depends on tackling the inefficiencies in bloated entitlement programs.”

Neglecting federal deficits heightens the risk of inflation. The Hoover Institution’s Jennifer Burns argues that inflation, fueled by pandemic relief spending, re-elected Donald Trump. She writes: “[I]n the early years of the pandemic, policymakers brushed aside concerns about emerging inflation as a relic of the past, perhaps believing they were in a new world where the old lessons didn’t apply.[...] Although he has inflation to thank for his victory, Mr. Trump shows little understanding of its dynamics. Many of his proposed policies may reignite the price rises he promised to cure [...].” To avoid making the previous administration’s mistakes, President Trump and the GOP Congress should pursue a fiscally responsible strategy as they face upcoming fiscal deadlines like the TCJA expirations. As Dominik Lett and I’ve written: “Failure to address runaway deficits will not only hurt American families—it could lead to political fallout as voters despise inflation.”

Reversing Biden's executive actions could save $1.4 trillion. The Committee for a Responsible Federal Budget (CRFB) suggests another avenue to cut spending—reversing Biden-era executive actions. Rolling back measures related to health care, student loans, and SNAP could save up to $1.4 trillion over the next decade (see table below for details). George Callas, executive vice president of public finance at Arnold Ventures, points out how the Biden administration increased spending by $1.4 trillion without any congressional action. “The ability of the executive branch to add trillions to the national debt with little or no accountability is a huge problem,” stated Callas in a post on X. Dominik Lett and I’ve argued that “[u]nchecked executive authority undermines the constitutional balance of power and bypasses essential legislative oversight. Congress needs to step up and tighten controls on executive spending, starting with better transparency and stricter budget rules.”

Temporary tax provisions and spending should be treated the same. TCJA tax relief is and has been the law for some years now. Maintaining that policy is not a tax cut and so there is no reason to "offset" the cost of maintaining current policy. That is, unless you're willing to argue for offsetting the cost of extending the farm bill subsidies, all highway spending, and all increases in discretionary spending to maintain current services, to name a few. Your position on this creates an undo bias in policy outcomes toward higher spending and higher taxes.

Second point -- a little economics would be good to mix in with the budget discussions. Deficits and debt do not produce inflation, which is a relic argument from Keynesian thinking. If they propelled inflation as you suggest, then why did inflation drop to near the Fed's target while Biden's deficits remained massive? Repeat after me -- inflation is always a monetary phenomenon. And, BTW, for the same reason, none of Trump's policies are inflationary. They may and likely will shift relative prices, and they may be sound or not, but they cannot produce more inflation without triggering a sympathetic response from the Fed in which case it was the Fed and not Trump's policies that caused inflation to accelerate.

“Reversing Biden's executive actions could save $1.4 trillion.”

You buried what should be the lede!

Most of the rest are same old same old exhortations for fiscal responsibility. (Well, in fairness, the offsetting TCJA extensions is new enough).

The last one is new and disturbing - and easily addressed!

Hopefully it will be - immediately and forcefully.