Debt Digest | Danish Pension Fund Divesting From US Treasuries

Links & Fiscal Facts

Here are this week’s reading links and fiscal facts:

Healthcare spending is the main cause of rising federal spending. At a hearing titled Reverse the Curse: Skyrocketing Health Care Costs and America’s Fiscal Future, Rep. Clyde (R-GA) emphasized that “Aside from interest costs […] the primary driver of our $38 trillion national debt is healthcare spending,” noting federal health spending has risen from “roughly $19 billion in 1975 to $1.8 trillion in 2025.” AEI’s Benedic Ippolito warned: “The federal government now covers 50 percent of total health expenditures.” The witnesses remarked that the incentives of Obamacare and other federal health interventions reduce choices and increase prices in healthcare and health insurance. Dr. Avik Roy of the Foundation for Research on Equal Opportunity (FREOPP) pointed to the Swiss system as an example of a healthcare system that allows choice and maintains fiscal sustainability with Switzerland ranked no. 1 in FREOPP’s World Index of Healthcare Innovation. Boccia and Michael F. Cannon submitted a statement for the record to the committee outlining a list of market-based reforms for the US healthcare system.

Danish pension fund divesting from US treasuries. Frances Schwartzkopff reports in Bloomberg: “The Danish pension fund AkademikerPension is planning to exit US Treasuries by the end of the month.” The rationale from the chief investment officer, Anders Schelde, is that “the US is basically not good credit and long-term the US government finances are not sustainable.” The divestment total is $100 million; “though a drop in the ocean in the context of the US Treasury market, the planned divestment by AkademikerPension marks an important symbolic step in the current political context as institutional investors rethink what constitutes a safe haven.” Alongside other events such as rating-agency downgrades, divestments are signals that investors are reassessing the US as a money safe haven. Boccia’s comment on Moody’s downgrade encapsulates the issue: “The downgrade is a signal to markets—and to the public—that faith in US political institutions to manage the nation’s finances is eroding. Moody’s is essentially saying: We no longer believe you’ll course-correct in time.”

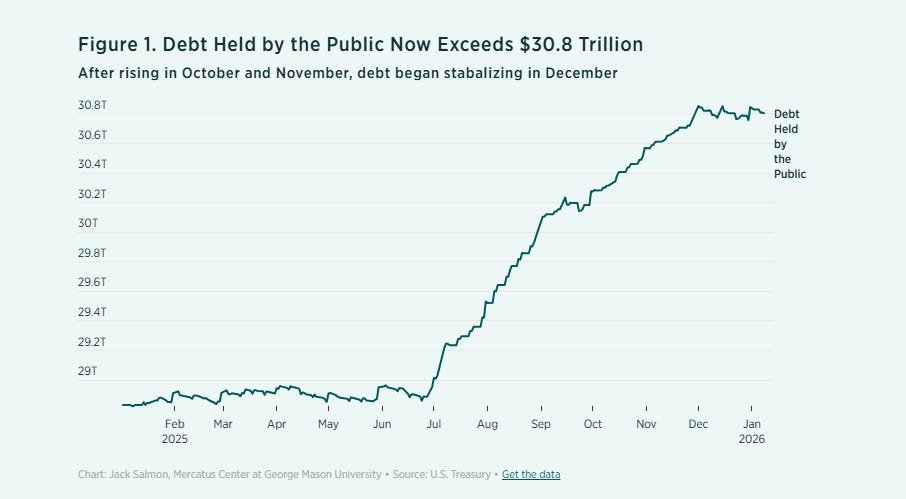

Debt held by public exceeds $30.8 trillion. Jack Salmon of the Mercatus Institute writes: “In December debt held by the public reached $30.8 trillion. This is an increase of a little over $2 trillion from the same time last year, or an increase of about $13,300 per federal taxpayer. […] As a share of gross domestic product (GDP), the public debt ratio is now 99%. This is the second-highest level on record (the highest level was in 1946 at 106%), and the Congressional Budget Office (CBO) forecasts our debt trajectory will reach a record high within the next three years.” Salmon emphasizes the consequences: “At this level of public debt, the US. economy forgoes almost 0.8 percentage points in potential economic growth based on a synthesis of nearly 200 estimates in the empirical literature.”

Trump administration pauses student debt collections. Danielle Douglas-Gabriel reports in the Washington Post: “The federal government will suspend tax refund seizures and wage garnishments for people in default on their student loans, the Education Department said Friday.” She quotes Maya MacGuineas, president of the Committee for a Responsible Federal Budget: “This is an incoherent political giveaway, doubling down on the debt cancellation from the Biden era. We’re not in a pandemic or financial crisis or deep recession. There’s no justification for emergency action on student debt, and no good reason for the President to back down on efforts to actually begin collecting debt payments again.” In terms of the cost, “The Committee estimates the pause could mean a loss of up to $5 billion per year in collection.” Douglas-Gabriel also quotes Cato’s Neal McCluskey: “Since the onset of COVID, repayment has in one way or another been repeatedly delayed, fostering an expectation that the federal government will never do all in its power to get the loans—and the taxpayers who funded them—repaid.”

Fiscal policy behaves as if the dollar’s dominance is guaranteed. Marcus Nunes explains, “There seems to be an implicit assumption that the dollar’s dominance is permanent, an immutable feature of the global economic landscape rather than a contingent arrangement dependent on continued confidence and prudent policy.” He continues, “This complacency manifests in several ways. Fiscal policy proceeds as if unlimited borrowing at low rates will always be available. Political leaders speak of the national debt as an abstract concern for future generations rather than a present danger.” He warns, “There is little serious discussion of how specific policy choices might affect international confidence in dollar assets. The implicit assumption seems to be that America’s ‘exorbitant privilege’ is simply the natural order of things. History suggests otherwise. Reserve currency status is not permanent. The British pound sterling once held the position the dollar now occupies, yet Britain’s fiscal problems and relative economic decline eventually cost it that status.” Nunes concludes, “The dollar’s reserve status is an asset to be carefully maintained, not a permanent feature to be taken for granted. Gambling with the dollar’s future through complacent policymaking is a risk the nation can ill afford to take.”