Here are this week’s reading links and fiscal facts:

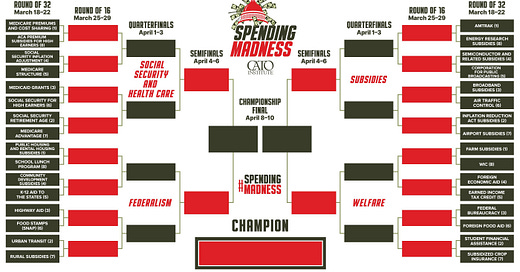

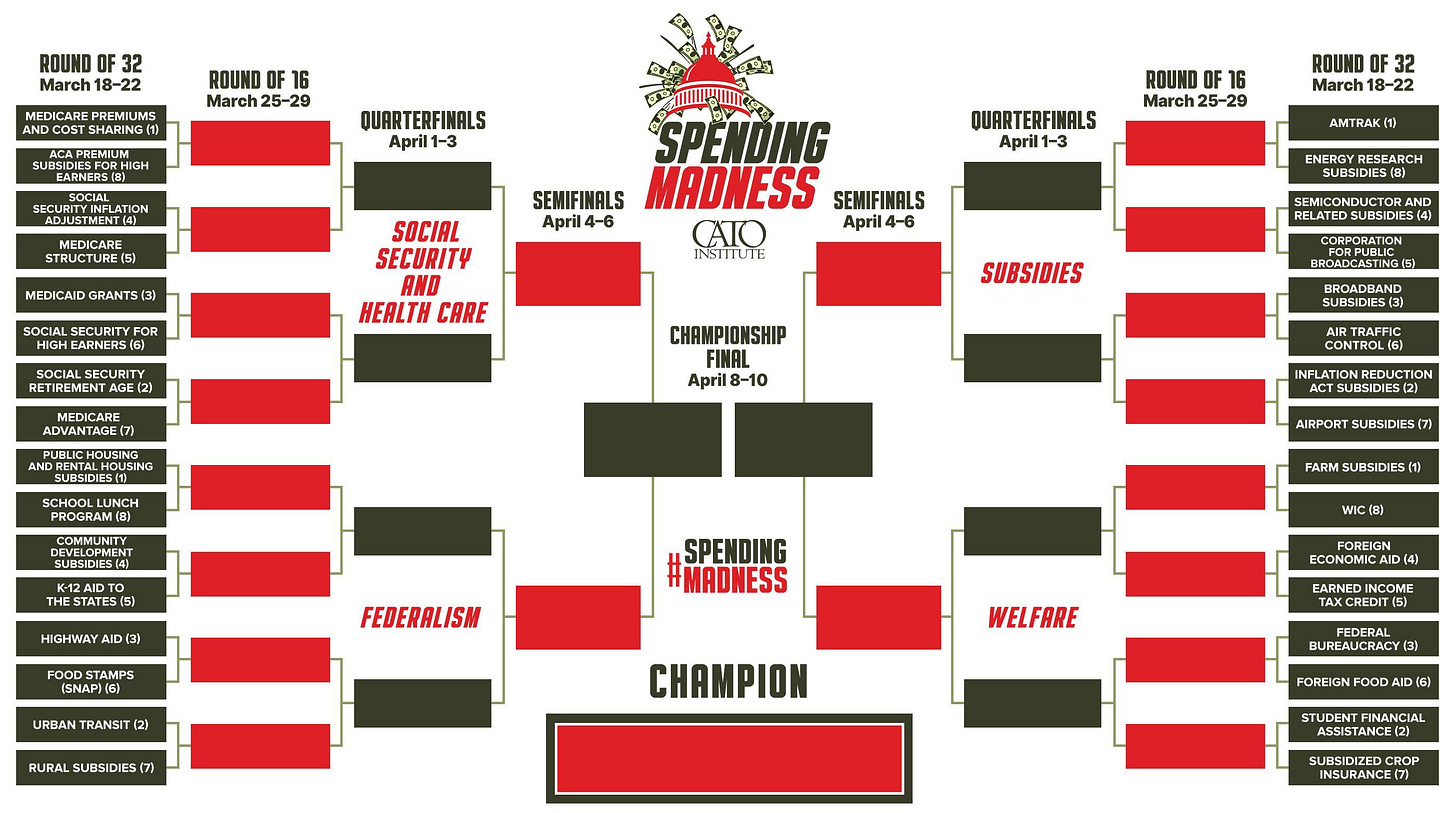

Cato’s 2024 Spending Madness tournament is live! With the federal debt projected to hit all-time highs within this decade as government spending is rising far above historical average levels, it is clear that the most prudent course of action is to cut government spending. On Monday, Cato launched the 2024 Spending Madness Tournament, where “Thirty‐two unaffordable federal spending programs are going head‐to‐head in a classic, single‐elimination tournament format. And you get to decide the worst of the bunch.” To cast your vote, follow this link.

Farm subsidies create perverse incentives. Two Colorado farmers were ordered to pay $6.6 million in penalties for tampering with rain gauges as part of a fraudulent scheme to claim benefits from a federal crop insurance program. This program is one of many farm subsidy programs that cost taxpayers more than $30 billion annually. As Cato’s Chris Edwards argues, in addition to harming the economy and the environment, “farm programs are subject to bureaucratic waste and recipient fraud.” Edwards suggests repealing all farm subsidies, pointing out that “Businesses in other industries face many risks and market fluctuations, yet they prosper or fail depending on their own skill and planning without a federal subsidy cushion. Farm businesses face some unique risks, but so do other businesses.”

The Fed’s large holdings of Treasury securities is concerning. A recent Congressional Research Service (CRS) report reviews the Fed’s pandemic stimulus, which expanded the Fed’s balance sheet to unprecedented levels and led to the worst inflation in several decades. Douglas Holtz-Eakin, former director of the Congressional Budget Office (CBO), explains, “ […] in 2020 and 2021, the Fed figuratively printed $5 trillion in new cash and bought Treasury securities and mortgage-backed securities at a rate of $90 billion per month.” According to the CRS, “In the long run, the Fed intends to hold primarily Treasury securities, eventually eliminating its MBS holdings.” CRS poses the following question for Congress: “Does the Fed’s large holdings of Treasury securities compromise its independence by making it more susceptible to subordinating monetary policy by providing low-cost financing of the federal debt? As Boccia has written previously: “The temptation to use the central bank balance sheet to fund federal government spending without having to resort to taxation or borrowing will only rise as the federal debt grows ever larger.” For more on the risks of the Fed monetizing the US debt, see here and here.

The Biden budget employs accounting tricks. In his analysis of President Biden’s federal budget proposal, Cato’s Chris Edwards argues that “[...] the Biden budget uses common accounting tricks to make the federal debt disaster look slightly less disastrous.” First, the budget projects sharp drops in nondefense discretionary spending, which is a highly doubtful scenario given the absence of policies to support such reductions. In addition, the unrealistic assumption that the child tax credit will not be permanent saves $2 trillion in 10-year deficits. “Just these two accounting tricks total more in added spending than the $3 trillion that Biden gets praise for supposedly saving,” says Edwards.

Unsustainable federal debt requires Congressional action. “New projections show that federal debt is so high that just paying the interest on it already costs more than defense spending this year. Debt service will exceed Medicare spending next year,” writes Kurt Couchman, a senior fiscal policy fellow at Americans for Prosperity. Couchman says that some members of Congress, like Sen. Mike Braun (R‑IN) and Rep. Tom Emmer (R‑MN), are actively working to address this issue through initiatives like the Responsible Budget Targets Act (RBTA), which would establish a Swiss-like debt brake in the US. For more on the ways to stabilize the federal debt, see here and here.

The dual advantage of raising the retirement age. The American Enterprise Institute’s Mark Warshawsky explains that increasing the full retirement age encourages longer labor force participation, leading to an increase in payroll tax revenues. According to Warshawsky, increased revenues, coupled with reductions in spending on retirement benefits, “has strong implications for current discussions in the United States about Social Security reform, as the program faces insolvency within the next 10 years.” For more on how to address the looming Social Security insolvency, see here and here.

Healthcare programs are the primary contributors to fiscal space erosion. Paul Winfree, from the Economic Policy Innovation Center (EPIC), estimates that fiscal space, defined as the federal government’s ability to borrow, will begin to diminish within the next 15 years. According to Winfree’s projections, higher interest costs and rising spending on healthcare programs, like Medicare, will initiate an erosion of the fiscal space by 2035 and lead to complete depletion by the 2050s. For more details on Medicare’s financing, see here.