Here are this week’s reading links and fiscal facts:

Debt limit deal math is misleading. The Congressional Budget Office (CBO) released its cost estimate for the Fiscal Responsibility Act, the product of negotiations between President Biden and GOP House Speaker McCarthy. Here’s what you should know:

The bill suspends the debt ceiling until January 1, 2025. A suspension is like a waiver. The bill temporarily eliminates the debt ceiling, allowing for unlimited borrowing for about a year and a half. Read more here about how debt limit suspensions work.

In exchange, the bill establishes statutory caps on discretionary funding of up to $1.590 trillion for FY24 ($886 billion for defense and $704 billion for nondefense) and $1.606 trillion for FY25 ($895 billion for defense and $711 billion for nondefense).

CBO scores the bill as saving $1.5 trillion over 10 years.

Unfortunately, that math is misleading as CBO does not take into account side deals that will undermine even the modest savings put forth in this bill. According to off-the-record sources, after repurposing funds and various other budgetary gimmicks, nondefense discretionary savings in FY24 will amount to no more than $1 billion. CBO assumes $64 billion in savings that year, which is also the basis for future savings estimates.

The bill also rescinds a portion of funding for the IRS and some COVID-related funds. It modifies work requirements for SNAP (Supplemental Nutrition Assistance Program) and TANF (Temporary Assistance for Needy Families) in such a way that spending will actually go up because more individuals will become eligible for assistance.

Fiscal policy deadlines approach. The Committee for a Responsible Federal Budget highlighted upcoming 10-year fiscal policy deadlines.

By the end of 2025, pandemic-era expanded Affordable Care Act health insurance subsidies and many 2017 Tax Cuts and Jobs Act provisions will expire.

By 2028, the Highway Trust Fund is expected to reach insolvency.

By 2031, Medicare’s Hospital Insurance (Part A) Trust Fund will reach exhaustion.

By 2033, Social Security’s Old-Age and Survivors Insurance (OASI) Trust Fund will be exhausted.

Misguided Social Security reform. The American Enterprise Institute’s Andrew Biggs critiqued Senator Cassidy’s (R-LA) Social Security reform proposal.

The proposal borrows $1.5 trillion, invests this money in the stock market, and then funnels proceeds to Social Security.

Rather than saving money now by investing and reaping the reward later, Cassidy’s plan borrows today to purchase stocks currently held by Americans. Future taxpayers will then repay those loans, with benefits flowing to the government.

In 75 years, the government would own roughly one-third of the stock market.

Debt ceiling deal won’t change the overall economic outlook. Economists at JPMorgan Chase and RSM US argue that the “proposed deal to lift the federal debt limit would have only a small effect on the cooling U.S. economy or still-high inflation…because it does little to reduce government spending that grew rapidly during the COVID-19 pandemic and its aftermath.”

Over the two years that statutory caps are in place, federal spending will be reduced by about 0.2% of gross domestic product (GDP) per year.

Address spending to reduce deficits. Cato’s Adam N. Michel recently testified for the Senate Budget Committee on the topic of taxes, growth, and deficits. He explained that rising deficits were the result of unsustainable spending growth, not a lack of taxes.

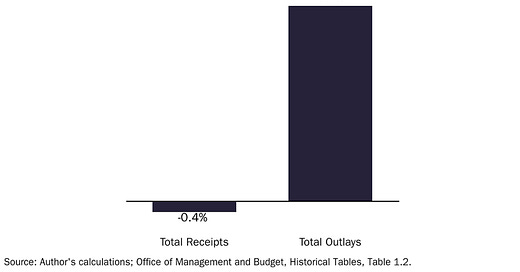

See the graph below for the percentage point change in spending and revenue as a share of GDP between 2000 and 2022.

Federal revenues this year will be a full percentage point above the historical average.

By comparison, the debt added under Biden from new deficit spending is more than three times the revenue loss from the 2017 tax cuts. Read his full testimonial here.