Here are this week’s reading links and fiscal facts:

Republicans float $5 trillion in deficit reductions. Per Politico, the House Budget Committee has floated a menu of more than $5 trillion in potential 10-year savings to offset the expiring Trump tax cuts. Cato scholars have discussed many of these promising policy options in detail, such as limiting gimmicky Medicaid provider taxes, reforming food stamps, and slowing the growth of emergency spending, to name a few. Republicans' willingness to seriously discuss these offsets offers a glimmer of hope for those of us worried about the nation’s worsening fiscal outlook. We’ll have to wait and see whether legislators will have the courage to follow through and pair substantive spending reductions with pro-growth tax cuts.

The GOP Budget Savings Shell Game. House Republicans asked the incoming Trump administration to hold off on reversing Biden-era policies via executive order so they can claim the "savings" in their reconciliation bill, Punchbowl News reports. Targets include Biden’s student loan forgiveness ($250B), EV incentives, and fuel efficiency standards—all part of a budget maneuver to offset tax cuts and border funding. There’s plenty of things the Congress could cut, without delaying executive actions. This is merely a fiscal sleight-of-hand. See the Cato Handbook on Executive Orders and Presidential Directives that our colleagues recommend that President Trump revoke or amend.

Bond markets send a warning to Trump and Republicans. The Wall Street Journal’s Richard Rubin and Sam Goldfarb write, “Tumbling bond prices have driven up the yield on the benchmark 10-year U.S. Treasury note to 4.8% in recent days, though it slipped Wednesday to 4.65% after fresh inflation data. That is up around 1 percentage point from September and a far cry from the 2% yields that prevailed in 2017, when Republicans enacted a $1.5 trillion deficit-financed tax cut. […] At the new, higher interest rates, every decision to borrow more money costs even more money. Every 0.1-percentage-point increase in Treasury borrowing costs adds more than $300 billion in interest expenses over a decade. The more the U.S. borrows, the less capital is available for the private sector. And the higher bond yields climb, generally, the more U.S. consumers pay for mortgages, auto loans and credit cards.” Last week, we explored in detail how spending cuts promote economic growth—which you can read here.

Treasury begins “extraordinary measures” as US hits debt ceiling. Treasury Secretary Janet Yellen announced that the federal government would hit the $36.1 trillion debt limit on January 21, 2025, prompting the use of “extraordinary measures” to continue deficit spending. These temporary accounting tricks, including suspending certain federal retirement fund investments, aim to buy time until Congress and President Trump address the debt ceiling. The so-called X-date, when cash runs out, will arrive this summer. As the deadline approaches, the debt limit should serve as an action-forcing event, with legislators adopting responsible fiscal reforms before increasing the debt limit again.

Pentagon spending hits historic high in September 2024. OpenTheBooks found that the Department of Defense spent $79.1 billion on contracts and grants in September 2024, marking its most expensive month since 2008 when the Iraq and Afghanistan conflicts raged. The spending spree, which OpenTheBooks attributed to “use-it-or-lose-it” budgeting rules, included $33.1 billion in the final five days of the fiscal year. Highlights included $7.9 billion on aircraft, $103.7 million on luxury food items like lobster tails and ribeye steak, and $211.7 million on furniture. Research from Jeffrey Liebman and Neale Mahoney suggests that reforming budgetary rules to allow some rollover of excess funds into the next budgetary year could reduce the incentives to rush spending and increase the average quality of projects they fund.

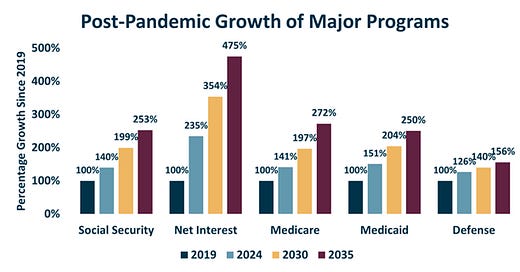

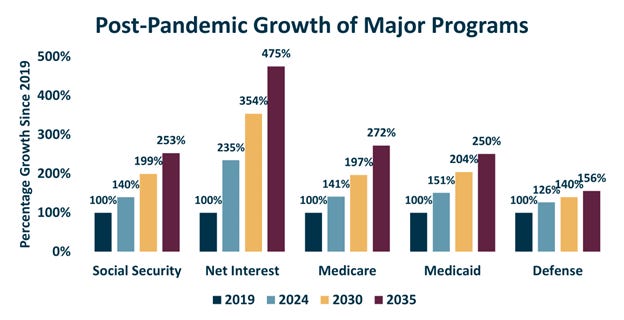

CBO sounds the alarm with new budget projections. Last week, CBO released its 10-year budget and economic outlook. As EPIC’s Matthew Dickerson explains, “The CBO’s baseline shows that unsustainable spending is the underlying problem of the budget. Government spending in FY 2024 was $2.3 trillion higher than FY 2019. This means annual spending is already about 52% higher than prior to the COVID-19 pandemic.” Spending will continue to grow over time, with outlays rising from $7 trillion in 2025 (23.3% of GDP) to $10 trillion in 2035 (24.4% of GDP)—far above the 50-year historical average of 21.2% of GDP. This growth in spending is driven primarily by rising interest costs and just a few entitlement programs (see the graph below).