Tune in to CSPAN from 8-9am ET this morning to watch Progressive Policy Institute’s Ben Ritz and I discuss government spending, Congress facing yet another potential government shutdown, and prospects for a debt commission. Livestream it here.

Here are this week’s reading links and fiscal facts.

Moody's cut its U.S. AAA credit rating outlook to "negative" from "stable" last Friday, citing large deficits and that "continued political polarization in Congress raises the risk that lawmakers will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability." That sounds about right. What I wrote when Fitch last downgraded the US from AAA to AA+ still applies: “we know that the U.S. budget is on a highly unsustainable path that threatens to undermine American prosperity and security if it goes unaddressed for much longer. Congress should seize this moment to establish a mechanism for stabilizing the growth in the debt…A well‐designed commission, modeled after the successful Base Realignment and Closure Commission (BRAC) can help Congress overcome political gridlock and signal to markets and credit rating agencies that U.S. legislators are committed to stabilizing the U.S. debt.”

Costly crop insurance subsidies. Cato’s Nicholas Thielman writes, “The Federal Crop Insurance Program has cost taxpayers about $90 billion between 2011-2021 and is projected to cost an additional $10 billion a year over the next decade…Reducing crop insurance subsidies would not only save taxpayer money, but it would also lessen a host of market distortions, environmentally damaging and discriminatory policies. Getting there, however, requires that we first pay-off the losers.” As Chris Edwards argues, “One option on the table is imposing tighter income limits on crop subsidies, which are currently paid to many high‐income landowners. Subsidizing rich people should be opposed by both progressive Democrats and Republicans of either the free market or populist variety.”

Bittersweet sugar protectionism. According to a recent Government Accountability Office report, the U.S. sugar program, administered by the U.S. Department of Agriculture, “creates net costs to the economy, because higher sugar prices created by the program cost consumers more than producers benefit.” The sugar program, which includes federal sugar loans and import restrictions, costs the economy $1 billion per year with a particularly hard impact on the poor. As R Street’s Nan Swift argues, “It would be best if Congress repealed the sugar program and let consumers and producers benefit from the global marketplace.”

87 percent of Americans want entitlement reform. Reason’s Eric Boehm writes, “A new polling [by the Taxpayers Protection Alliance] shows that the vast majority of Americans believe policymakers should make changes as soon as possible to extend the life of America's two old-age entitlement programs and avoid possible benefit cuts that will hit in the early 2030s if nothing is done.” Notably, 71 percent of Americans support limiting Social Security benefits for wealthy, high income beneficiaries. Boccia highlights similar commonsense Social Security reforms here.

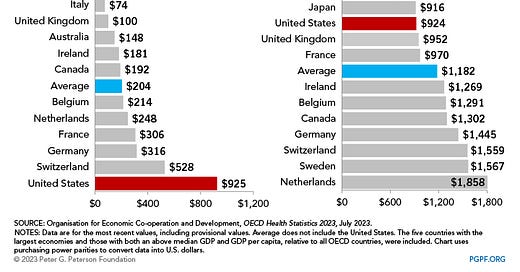

Excessive healthcare spending on administrative costs. The Peterson Foundation explains, “Healthcare spending is driven by utilization (the number of services used) and price (the amount charged per service)…Despite spending nearly twice as much on healthcare per capita, utilization rates in the United States do not differ significantly from other wealthy OECD countries. Prices, therefore, appear to be the main driver of the cost difference between the United States and other wealthy countries.” One factor: “inefficiencies and administrative waste that derive from the complexity of the U.S. healthcare system.” As the graphic below shows, the US spends $900 per person on administrative costs—four times the average of other wealthy countries.

Medicaid spending on children. A new Congressional Budget Office working paper argues that Medicaid spending on children increases earnings in adulthood, offsetting half or more of the program’s initial outlays. Currently, around one-fifth of Medicaid spending goes to children. “Given the enormous taxpayer resources devoted to Medicaid, it is important to ensure the program fulfills its mission of delivering healthcare to the most vulnerable Americans…There is strong evidence of a shift of financial resources away from certain vulnerable enrollee populations, the most notable being from low-income children. Per capita Medicaid spending growth on children in expansion states was less than one-third what it was in nonexpansion states and less than one-quarter of national average per-capita healthcare spending growth,” write the Mercatus Center’s Charles Blahous and Liam Sigaud.

Spending drives $2 trillion deficit. The Tax Foundation tweets, “Outside of the pandemic years, this year’s federal deficit of $2 trillion is the highest in U.S. history. While tax revenue has increased about 28 percent since the pre-pandemic year 2019, spending has increased about 46 percent.” The Tax Foundation’s graphic shows federal tax collections and spending since 2000.