Here are this week’s reading links and fiscal facts:

Cut wasteful defense spending. Last year, the Department of Defense included $25 billion in “unfunded priorities” on top of the $773 billion topline request. Senators Elizabeth Warren (D) and Mike Lee (R) say the wish list undermines cost projections, incentivizes budget gamesmanship, and promotes wasteful spending. Meanwhile, the Heritage Foundation’s Kevin Roberts argues that Congress should “authorize a new round of Base Realignment and Closure (BRAC), which overcomes parochial interests to close down unneeded bases in a fair and strategic manner, and to apply the same philosophy to the rest of the budget.” Read Boccia’s piece on using BRAC for other government programs here.

Questionable Social Security numbers used for $5.4 billion in pandemic spending. The Pandemic Response Accountability Committee identified nearly 70,000 Social Security numbers which did not match government records. Social Security has become bloated beyond its original purpose and is overdue for change. AEI’s Andrew Biggs proposes capping the maximum benefit to cut annual costs of $1.3 trillion in half.

No Senate budget resolution. New Budget Committee Chair Sheldon Whitehouse says the chamber may not even pass a framework this year. “We’re never going to get a budget resolution passed through the House that we agree with,” which “limits the effectuality of it all.” Congress shouldn’t be rewarded for failing to complete its job. Boccia suggests tying congressional pay to performance here to “encourage members to grapple with the size and scope of federal spending and to put their policy priorities into the context of fiscal realities.”

Federalism is a necessary check on Congressional power. The Congressional Research Service explains that state sovereignty limits Congressional authority by restricting the scope of the federal government’s power. Cato’s Roger Pilon writes that restoring federalism promotes good governance, protects civil liberties, and revitalizes American democracy.

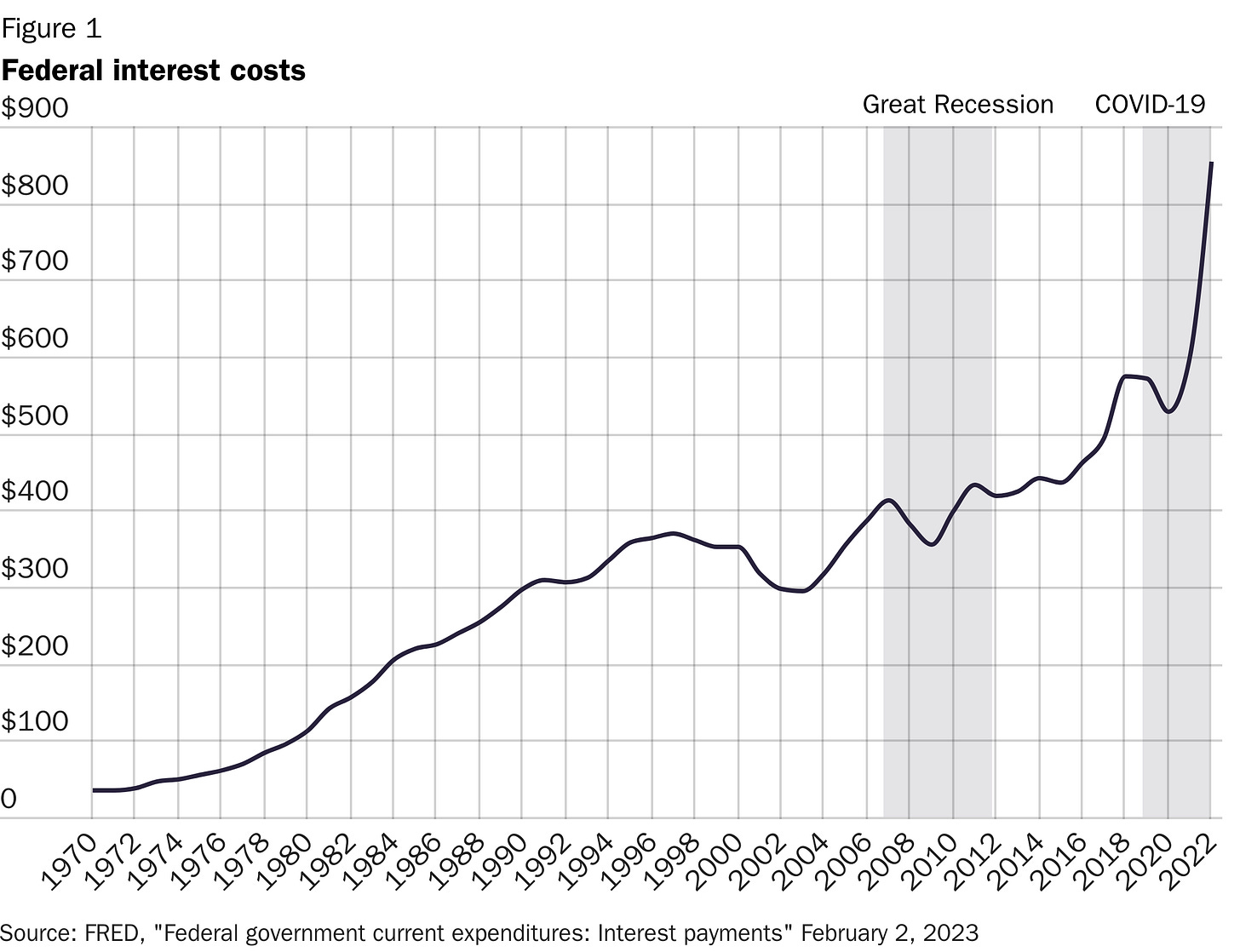

High and rising debt increases interest costs. Federal interest payments reached a new high of $853 billion for Q4 2022 (see the graph below). That’s 17 percent of FY22 revenues. By 2052, CBO estimates interest costs will consume 40 percent of federal revenues. Read about the consequences of unsustainable debt here.