Cutting Deficits Is Not the Same as Cutting Debt

If we want to cut the debt, we need to focus on reducing spending

On June 4th, the Congressional Budget Office (CBO) sent a letter to Democratic lawmakers requesting an “estimate of the budgetary and economic effects of increased tariffs implemented through executive actions between January 6 and May 14, 2025.” The letter itself is short but summarized as: the Trump tariffs will reduce the federal deficit by $2.8 trillion over the next decade.

Scott Lincicome masterfully points out that there are several problems with the CBO’s estimates themselves. But there is a further troubling trend as plenty of news outlets are fundamentally misunderstanding what these numbers, inaccurate though they may be, even represent. For example, a recent NPR headline reports that this will “modestly reduce national debt [but] slow economic growth.” This is simply not the case and represents a fundamental misunderstanding of the difference between deficit and debt.

A deficit occurs when any entity, whether it be a person or a government, spends more money than it collects in a given year. As an example, if I take in $100,000 in income this year and spend $110,000, I would have $10,000 in deficit spending, which I would have to finance by borrowing from someone else, be it a bank or a family member.

By contrast, debt is the total accumulation of all the past deficit spending. To continue the example above with the simplifying assumptions that I didn’t pay off any earlier year debts or accumulate unpaid interest, if my earning and spending habits persisted, unchanged, for the next five years, I would run deficits each year of $10,000 and my total debt at the end of that period would be $50,000.

Let’s compare this to the federal government. For 2024, there were $4.92 trillion in revenues collected against $6.75 trillion in spending. From this, we can arrive at the $1.83 trillion in deficit spending just for 2024 alone. By adding all of the previous years’ deficits together, we arrive at our current level of national debt: a staggering $36.2 trillion.

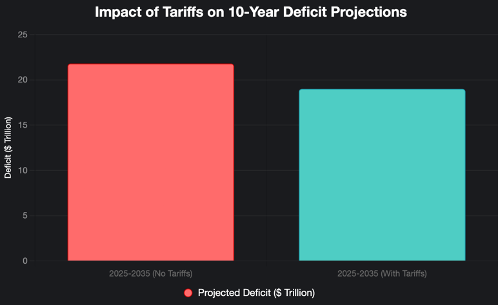

The CBO has projected that the deficit for just 2025 will be $1.9 trillion. They also project deficits through 2035 and, while there are reasons to believe that these numbers will not prove to be accurate, the CBO uses them as their baseline for comparing the budgetary effects of proposed legislation. All told, the total deficits for the next ten years will be $21.8 trillion.

So, if we want to understand the CBO’s letter, we should do so fully and transparently. What the CBO actually said is that the total deficit over the next ten years will be a mere $19 trillion (thanks to the tariffs) rather than the full $21.8 trillion that they had previously projected. In other words, in 2035, the total national debt will be somewhere around $55.2 trillion instead of $58 trillion. That is less of a disaster, sure, but there’s no reason to throw a parade over this.

All of this belies a simple truth: the federal government does not have a revenue problem, they have a spending problem, plain and simple. If we want to get serious about actually reducing the national debt rather than celebrating reducing deficits, we need to look at cutting spending.

“Cutting spending,” however, does not fully capture what is necessary. Making promises and underfunding their delivery, commonly known as starving the beast of resources, is a recipe for disaster that has been tried and failed. Instead, we need to look at starving the beast of responsibilities.

In doing so, the federal government would shed responsibilities – i.e. things that they are obligated to spend money on – and could then use the savings from those to start paying down the national debt.

We need to have a frank and serious conversation about the proper roles of government in society and we need to have it soon. The debt trajectory we’re on now is very clearly untenable and will not only impede our economic growth but will hamper our nation’s capabilities, making us all less safe. Retired Admiral Michael Mullen, then the Chairman of the Joint Chiefs of Staff, said as much in 2010, when the federal debt was a mere $13.5 trillion and an annual federal deficit of $1.29 trillion. Time is running out.

David Hebert is a Senior Research Fellow at the American Institute for Economic Research. Follow him on X: @Dave_Hebert and on Substack:

Advancing Big Ideas: Guest Posts at the Debt Dispatch

One of the things we value most at the Debt Dispatch is thoughtful debate on important fiscal issues. To deepen our exploration of big ideas, we’ve started featuring guest posts on provocative topics—especially where researchers disagree. Our goal is to surface different perspectives, invite critical thinking, and push the convers…

Nicely written article on important matters Dave.

Please see my Substack article today on the Severity of the Federal Debt: https://tommast.substack.com/p/federal-debt-risks?r=b29s7

Tom Mast